Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.

00:43

It’s kind of the last step in the accounting cycle. It’s really preparing for the next time period. So we had our adjusted trial balance. This happens right after we have our normal day to day journal entries, which are bills, invoices, checks, then we have the unadjusted trial. Then we make our into period adjustments to create the adjusted trial balance. And we use this to generate the financial statements. That’s the end result. Once we have those financial statements, then we have the closing process, which is set up to set up the next time period. So we can think of the closing process. And it’s good idea to think of it in this one step process intuitively, because a lot of software will actually do the closing process for us. So it will be an automated format. But when we print report to report, we need to understand when when we see these reports doing things, what is happening in terms of that closing process. And it’s easiest to think of that in one big journal entry. That’s kind of one step process.

01:44

So the unadjusted trial balance looks like this. It’s got the temporary accounts down here. And what we’re trying to do is get to the post closing trial balance, meaning we’re trying to close out all the temporary accounts and close them out to the owner capital account. Therefore The adjusting journal entries and the post closing trial balance, the adjusted trial balance and the post closing trial balance are exactly the same all the way down from assets to liabilities and differ when we get to the equity section in the case of a sole proprietor here, in the case of capital account, our capital account in the post closing is including all of these accounts down here, which are broken out on the adjusted trial balance. And so that’s what our goal is, when we do the closing process, we’re just trying to get from this point to this point. And that’s what we can imagine we could say, Hmm, that’s what we’re trying to do.

02:36

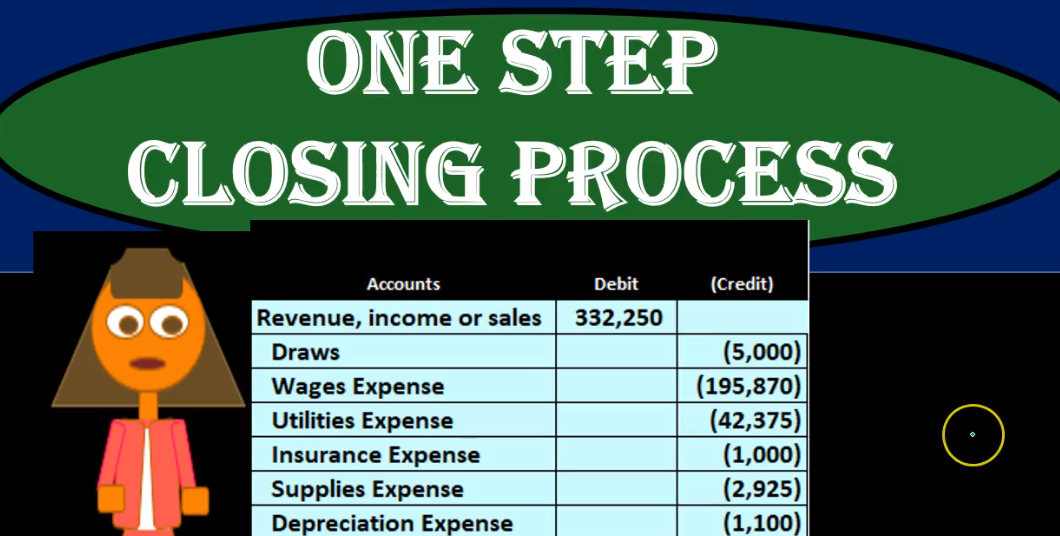

And we want to see that we want to visualize that we want to understand that and it’s easy to do so when we see the troubles because we can see that all the temporary accounts are below the equity accounts. Those are all the accounts we need to make go to zero. So when you’re remembering all temporary accounts, you can kind of say that’s going to be everything from the income statement down, plus draws or dividends if it was a corporation. So to do that, We can just start building our journal entry, we could say, here’s our adjusted trial balance. And we could say, what do we need to do in order to get this adjusted trial balance all the temporary accounts down to zero, all the accounts below the capital account, we need to make zero. So I’m just going to start creating a journal entry based on this information. So this first draws has a debit balance.

03:23

Therefore, I’m just going to start making our journal entry we’re going to credit the draws here. And if we post that as we go, we’re not completed with the journal entry, we only have one transaction one account so far. But if we credit 5000, then if we post that 5000, we will bring that account down. So that’s what we’re going to do. We’re just going to do whatever we need to do to make all these temporary accounts go down to zero, and then we’ll figure out what to do from there. Note as we go through this process, that we’re not really thinking about putting the debits first right now, we will go back and decide if we want to put all the debits on top and the credits On the bottom, at this point in time, we’re making a journal entry to best be able to make it in the most efficient and quickest way. And we’re also want to be able to go back to it and understand it in the best, most efficient way. So we’re out of balance, of course now by the 5000.

04:16

Until we complete recording this next account is revenue or income, it has a credit of 330 to 250 represented by the brackets, we need to do the opposite thing to it to make it to go down, which in this case will be a debit. So we’re just going to be creating our journal entry as we go. We made a second account here, we’re going to debit revenue, for whatever we need to whatever is in there to make it go down to zero. Once we then post that we’ll have the credit here. The debit matching out to it bringing the balance down to zero. We’re still out of balance, but we are achieving our goal. We’re just building our big journal entry our big one step journal entry up top. Next, we have the wages expense, which has the 195 eight 70 it is an expense, all expenses will have a debit balance, we need to make it go down by doing the opposite thing to it, which in this case will be a credit.

05:09

So it’s a debit represented by not having any brackets, we’re going to do the opposite thing to it in our journal entry, we’re going to put the wages indented, put a credit 195 870, when we then post that it’ll break the 195 870 down by 195 870 debit and a credit being the opposite, bringing the balance down to zero. So we’re just creating whatever we need to do. In order to make these accounts go down to zero. We’re still out of balance, we’re going to move on to utilities now, utilities and expense. Notice everything down below this is going to be expenses. So we’ll see a familiar pattern here. It’s got 42,003 75 in it, it’s a debit represented by no brackets, we’re going to do the opposite thing to it in order to make it go down. Therefore we’re going to credit utilities expense so here’s utilities expense. We’re going to post it here, and that’s going to credit it bringing the balance down to zero. just build in our journal entry.

06:06

Next, we’re going to go to insurance. Here’s insurance expense up top, I’m sorry, here’s a church expense down here, it’s got $1,000. In it also an expense, also, therefore, a debit balance, we need to make it go down. So within our journal entry, we’re going to do the opposite thing to it. And we’re going to credit the expense for the 1000. By the way, you might be wondering, note that throughout prior presentations, we said that expenses only go up with a debit. And income only goes up with a credit typically meaning revenue really only goes one way we earn revenue we don’t typically not or earn negative revenue, and expenses only go one way all these things like wages, utilities, insurance, we only pay them they don’t typically pay us the exception to that rule or then kind of like the resetting it’s not really an exception is that when we do the closing process, of course, we need to make these go down to zero, but it’s not like They’re going down.

07:00

And really what’s happening is we’re just resetting the clock, we’re trying to set the timer to set a different time period that we are recording to. So that’s why we are doing the Atmos should look funny, because we never really credit wages expense or utilities expense or insurance expense or debit revenue only during the closing process or some unusual circumstance. So that’s going to bring this down to zero. Next, we’re going to go to supplies. So here’s supplies, it’s got one that’s got 2925 in it, we’re going to make it go down by doing the opposite thing to it, which in our case, is a credit. So we’re going to credit the supplies account with a bracket in the credit column, post that over here and that’s going to make the balance go down to zero. Last one. depreciation expense got 1100 in it, it’s an expense. Therefore having a debit balance, we’re going to do the opposite thing to it a credit. So we’re going to credit depreciation expense by that 1100. posting that out brings the balance down to to zero, and there we have this information.

08:04

So now of course, we’re still out of balance, meaning our debits do not equal the credits. And we’re going to think about, what do we want to do next. If we see that from a journal entry format, this is what we have, we’ve got debits. If we sum up the debits, they add up to 332,250. If we add up the credits, 5000 plus 195 870, plus 42, is 375 plus 1000 plus 2009 25 plus 1100, is 248 to 270. So the 330 to 230 50 minus the 242 70. The debits minus the credits mean we have a difference of 83,980. That’s what we need, in other words, in order to make the debits equal the credits, so if we put that on the credit side, we’ll be in balance. So now we’ve got these credits will add up to the debits of 330 to 250 each. So of course We just need to know what account that will be. And what we’re going to be doing is closing all of this out to the capital accounts and we’re closing everything out to the capital account, that’s going to be our final journal entry. Let’s see, if we post that.

09:14

Then the plug here that we just put in was to the capital account, and it’s going to go to the owner’s capital here, increasing the owner’s capital. Now, this is the step that’s a little bit confusing to us. Because when we look at a two step or a four step type process, we’ll see what exactly is being included here in steps meaning we’ll see net income going in here and then draws. So what does this include? It includes the entire income statement, which is revenue minus expenses. So the credits minus the debit is 88 980. And that is net income. That’s part of this number 88 980. But we also included the other temporary account which is an owner’s equity. account, and that’s draws. So draws also close it out. So we’ve got net income minus the amount of draws, which is this 88 980, which we put here, which is a net increase net income brings this amount up, draws brings this amount down, just like the statement of owner’s equity. So this is this process is comparable to the statement of owner’s equity where we in essence, increased capital by net income, all of the revenue minus the expenses, meaning it went up net, all of this made it go up by 88 980. And then we recorded the draws, which was the final component, which brings the capital account down by the 5000. That’s how we get this 83 980. So this is going to be the final journal entry. Where we could rearrange it. Note, when we look up here, we said that we didn’t put all the debits on top and the credits on the bottom. It’s not necessary to do that. And it’s even might not be desirable to do that because it might be easier to go back and look at this journal entry and say, I know what I did here. I know I just took these accounts and put them in an order. But if we want the debits on top just for formatting purposes, then we can just put the revenue on top and then start with the draws going down. The reason we didn’t do that up here is because we just started in order we said draws first and just went straight down. And that’s the easiest way to think about it when posting to a worksheet. And then we can go back and just and just reformat this and put the revenue on top, then draws then all the expenses followed followed by the capital account.