This presentation we will continue on with our statement of cash flows, we’re not going to enter the final adjustments that we will need to finalize the statement of cash flows to bring those last few numbers to the correct balances. In order to do that, we’re going to use this information we’ve got our comparative balance sheet, our income statement and additional information. We put together most of our information so far with the comparative balance sheet, which we made into a worksheet. Now we’re going to use some of these other resources, the income statement, the additional resources to make those final adjustments, those fine tunings that are needed to get those few numbers that we have left and noted into balance. And this is going to be part of the normal practice where once we get this information set up, we can then make some comparisons such as net income does it tie out, such as depreciation does it tie out on the cash flow statement to what we see here on the income statement, then we can have this other information which will be given in both problems in practice, of course, we’ll just go to the gym. General Ledger. And we’ll get this information in a book problem, we don’t want to give all the detail of a general ledger or just when we’re going over an example.

01:06

So we have to just kind of give this other information in practice, we go to the GL and we can see that information and we’ll pull any documents we need, including if we purchase the equipment and we took a loan out or any of that kind of stuff. We’ll purchase that we’ll pull that out. We’ll talk a little bit about that process as we go through here. So now what we want to do is look through these journal entries related to this additional information. And if we think about what we’ve had so far, we noted that there’s going to be a couple areas we need to go back to and fix one we noted that that net income didn’t tie out to the to the income statement, we noted that depreciation didn’t tie out. And we noted that the equipment that we put on the books, probably something more happened, that’s always something we need to go back to. And we noted that the notes payable is probably something more to it than just taking the difference between Notes payable, it could be more activity. In practice, we would look at the GL again here, they’re just going to give us that more activity. And we’re going to try to figure out, Okay, what types of journal entries is this added activity given related to? Now obviously, if they’re giving this information in like a book type problem, then we’re going to it’s useful just to go through that and think about it.

02:21

Okay, what is the journal entry related to these, in practice, we would always pretty much do this for a cash flow statement for the equipment accounts. And the loan account, if there’s any activity, we would naturally go through there, figure out the few transactions related to it, and what the journal entries would be. And note that these types of accounts don’t have a lot of activity. So it shouldn’t be too difficult to do that, meaning, we’re not going to buy equipment every day. It’s not like inventory. So whatever activities there, there should be fairly few of it. And we can figure out what happened and make these types of adjustments as needed. We’re going to start here with E because that’s actually going to be a smaller journal entry. So that’s where we’re We will start we’ll pick off that one first then move from there says we declared and paid cash dividends of 53,600. So anytime we get this added information, I would think about the journal entries related to them and then go We’ll go back to our worksheet and say, Okay, what are we going to do with our cash flows, David based on this information. So if we declared and paid cash dividends, we could think of that as two journal entries where we declare the dividend have a payable, and then we pay it. But if we combine those two out if they both happened in that same time period, then in essence, we had retained earnings and cash.

03:33

In other words, cash went down, we paid cash, the debit is going to go to retained earnings, bringing down retained earnings. So and this is similar to like if withdraw for a partnership or sole proprietor, so we gave money from the company to the owners in the form of dividends, cash went down, and we debited the equity account, in this case retained earnings for a corporation. So what does that do if we think about that journal entry? What was We’re going to do to our cash flow statement. Well, on the cash flow statement, we can think well, net income is going to be affected here on on because of this retained earnings. Why? Because remember when we made this net income? What is it from? It’s from the difference in our worksheet between the retained earnings? So we made the assumption, we said, okay, we didn’t pull this from the income statement, we said, what would it be represented as on the difference between the balance sheet accounts and typically, it would be the difference in retained earnings, because we closed out the retained earnings. Two are the net income to retained earnings. So the major difference between retained earnings between two accounting periods should be net income. And that’s what we used here. We noted that it wasn’t the amount that’s on the income statement said, Hey, we’re going to go back and fix that.

04:52

Now. We’re going to go fix that we’re going to say okay, net income is one of those areas that this hopefully will bring us now in balance with the income statement, but There’s got to be something else happening here because we’re already where we want to be. So there’s got it, we got to do something equal and opposite kind of like a journal entry somewhere else. So note, I set this up kind of like a journal entry where we’re increasing and decreasing. If we do something to net income here to make it correct, then the other side, we can put here to cash, debit cash, paid for dividends, that’s going to be down here in the financing. So we paid cash for dividends, that’s what happened here. So we’re going to make net income correct, basically. And then we’re going to post the difference here to cash paid for dividends. Note that if we didn’t do it this way. So let’s see what that happens. If we do that, then we’re going to say, Okay, here’s net income went from one to four 500. I’m kind of putting this like as if it’s an adjusting worksheet for adjustments in terms of adjusting entries. And here’s our Indian adjusted cash flow. The other side of it’s going to go down here. And that of course should keep us in balance. So we’re not talking about debits and credits, but we’re using kind of a similar system, we’re saying, Hey, we tied out to the 61 900. Already, using the numbers that we get from our worksheet. If we make any adjustments, we want to do it systematically, we want to say, Okay, if we’re going to adjust net income, to what is on the income statement, hopefully, then we also want to adjust something else. So that that difference that we got from the difference in retained earnings is still there if we did not do it this way. In other words, if we took this number, which is the amount on the income statements working, here’s the income statement, here’s this number. That’s the number we wanted. If we started out just pulling this number, and saying that’s going to be our first number that we work with, and our first number that we’re working with is not on our worksheet that we’re using, then it’s very likely that we wouldn’t understand what what the differences are be able to figure out why we’re not in balance. If we use this number, which is not net income, but then go through this whole process, then we can now figure it out in a systematic way.

07:00

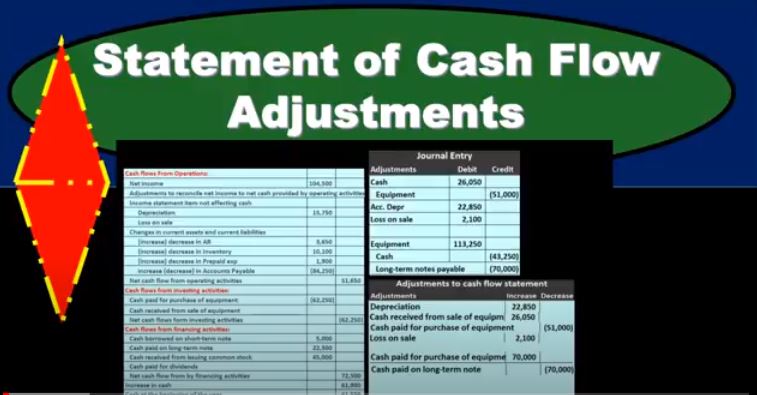

Note also that we have to do this whole thing, basically to have the space down here to have it built out to be able to break this number out between the two. So now we can go down here and say, okay, the other side of it’s going to go to cash paid for dividends, and it’s going to be a financing activity. And that’ll put us back in balance. So cash went out, because we paid for dividends, it’s financing, because we’re dealing with the owner. Not it’s not a income statement activity. So it’s not in the operating activities. We didn’t buy anything for the company. So it’s not in the investing activities. We’re dealing with financing the company and paying back the owner, therefore, it’s in financing. So that’s going to be our first adjustment that we’ll have. And that of course, makes net income tie out. So that worked. So that looks good. Now we’re gonna do our next adjustment. And we’re going to say that we’re going to have the sale sold equipment. We sold the equipment and it says we received 26,050. So if we think about the journal entry first, and then kind of think about what We’re going to do in terms of increases and decreases to our cash statement, we’re gonna say, okay, the cash went up, equipment must have gone down, and then the accumulated depreciation, it’s going to be a debit, because remember, it’s on the books as a credit, we have to debit it to make it go away the difference, then it’s going to be 2100. And that’s going to be a loss. So that’s what we need to be in balance. That’s the plug. So if we took this plus this minus this, we’d need 2100 in order to remain in balance.

08:30

So we know that this is going to be a loss, we can think of it a couple different ways. One, it’s a debit. And it’s kind of like an expense expenses or debit balance accounts. Therefore, it’s probably a loss, not a gain. And two, if we looked at the book value, which would be the 51,000 minus to 22 850, that that would be greater than the cash we got, and therefore it’s a loss. So that’s why we’re going to name it a loss here. And then we that’s not the only thing that happened to equipment though. So notice the equipment of course is more messy, then we would just assume like we just got cash and sold the equipment. So the other side of this is that we bought equipment. And how would we know this you might be asking, we would look at the GL, we’d look at the two accounts that made the difference up in the general ledger, then we would find the journal entries related to it and the documents, possibly for those purchases. So then the equipment went up by 113 250. Cash, we paid 43,002 50, and we financed it 70,000. So that’s common because we buy an equipment and we didn’t have the cash for it. It’s common to finance the equipment. So we have this debt now. So these two then are going this is where the most complicated component is of these journal entries of these types of cash flow statements generally to figure out the equipment because notice all these accounts, it’s it’s affecting. Now, if you do everything up to this point, the way we’ve looked at it, even if you can’t figure out this last step, if it’s a book problem, you will have picked up a lot of points if it’s a problem in practice. is you’ll be able to go to your supervisor, whoever and say, Look, I know exactly what the difference is I know exactly what’s going on, I know exactly how this thing ties out, and it has to do with equipment. And you could start from there and not have to start the whole thing over again. That’s that’s the point of this process.

10:16

Now, our goal now is to take these journal entries in, look at our cash flow and try to say, Okay, how are we going to apply these in terms of an increase in decrease convert this into kind of like an increase decrease to our cash flow accounts, so that we’re still in balance. So we’re going to use those same kind of balancing concept to adjust these out so that we’re still in balance here. So whatever we do with these journal entries, we got to find a home for them. And kind of like an increase in decrease mode. So that we’re still in balance, that’s going to be our goal is again, a little bit difficult, a little bit more difficult to do this. Now, we noted that we saw when we built this cash flow, that depreciation was not right, because it didn’t match what was on the income statement. We note that we saw a sale a loss on the income statement, and we didn’t put the number here so there’s probably something there and We noted that cash paid for equipment was probably too simplistic when we put that on there, and we noted that the cash paid for the long term note, again, probably too, too simplistic. So we noted that all these things could have more detail to it. However, because they’re all tied together with each other the equipment the loan, it would have been very difficult for us to do that as we construct. So it’s better for us to put these numbers there and now go back to it and say, okay, the here’s the puzzle, we’ve got these journal entries, and we have to fix these accounts.

11:33

Now there’s a couple things we know we know what the losses because it’s on the income statement. And we know what depreciation is because it’s on the income statement. And now we know these journal entries. So let’s take this information and try to see how we can adjust these accounts. So first the depreciation we’re going to say we’re adjusting depreciation that’s going to be basically this number were picking up and we can verify that by saying okay if we adjusted depreciation if we increase the purchase By 15,007 50, will that come out to the depreciation on the income statement? And we’ll see that we’ll we’ll have to check that. And then we’re going to say that the cash received from equipment, we’re going to basically say that that’s coming from this account. Now, that might not be as intuitive. We’re going to say, Well, why is that? Well, this is debit in cash. And we that’s our cash flow statement over here. And we’re just need to know, where did that cash come from? That we’re looking at cash flow here. Well, that cash flow came from equipment that that we sold. So and then we’re going to ask ourself, what was that operating, investing or financing? It’s not going to be operating because it’s not really an income statement account, this accounts income statement, but the bulk of this isn’t really an income statement transaction.

12:45

Really, it has to do with buying or selling an asset, which is an investing activity. So we’re going to be dealing with cash received, we’re going to say it’s an investing activity. We sold property, plant and equipment anytime we do with property, plant and equipment. It’s typically going to be dealing investing activity when we’re working with a cash flow statement. And then we got cash paid for the purchase of equipment, that’s going to be the 51 here. So the 51. And so why would that be? Well, cash paid for the purchase is where we put the entire thing that the entire difference between that’s really a result of kind of these two journal entries. So we’re breaking this out, in a sense, to its components now. So that’s going to be that’s why this has got to be a component, and it’s got to go down. And then we’ve got the loss. And the loss is something we can see here, we knew it was on the income statement. So we’re going to pick up that loss and put it here so of these, you could probably figure these out. And then you got to go Okay, that’s this is where the difference is going to go to because that’s where we put everything to so that’s, that’s the other side of it. And then we’ve got this journal entry. Now the major thing with this journal entry is that we’ve got this loan, this financing amount here.

14:00

The financing amount is going to be the issue because the financing amount is not cash related. So we’re going to be dealing with the 70,000. So we’re going to say that cash paid for long term note here is going to have to be adjusted, because that’s going to be the note payable. The other side of it’s going to go to cash paid for the purchase of equipment, which is where we put everything that’s the other side of this transaction. So you might want to spend some time with something like like these journal entries and try to figure out why that you know, more than more than over a few times, if we were to post this out them in terms of this kind of increase in decrease, not really a journal entry, but a similar kind of concept to our worksheet, we’re gonna say, Okay, here’s where we were at before we’re in balance, this matches what’s on our balance sheet, we need to do increases and decreases here in such a way that we don’t affect the bottom line. So they have to equal in some way. So if we do our adjustments that we had, were gonna say depreciation will record that gets us to 38. So it was at 15 seven 50 plus 22 850 brings us to 36. The loss, we didn’t have one before it’s going to go up by 2100 2100. We had the cash paid for equipment was at 62,002 50, there were two transactions. So this is the net of those two transactions bringing us to 43 to 50. And then we had the cash received from the sale of equipment 2650, bring it up to 2650. And then we have the cash paid for long term debt that kind of flipped this one. This we would have thought it was a receivable and now it flipped it 70,000 paid. So now it’s really paid right 47 500. So this is going to be the activity we have. Now if we look at all that then here’s our adjustments we just had, they add up to zero, the additions and subtractions add up to zero, so we end up in the same spot as is the point so we got to this amount by doing a simplified method. Just looking for the differences in our two in our balance sheet. counts, so that we know we tied out. Then we went back and looked at those problem cases, and figured out our Indian numbers made these adjustments in such a way that they’re going to be in balance. So that we’re still in balance here. And now we can tie out these numbers we can say does net income work? Does depreciation work? Well, if we go here, net income 158 100 depreciation 38,600, should be on the income statement.

16:28

So it looks like those are going to be going to be good. And of course, when we go to the to the loans, we want to be able to say does that tie out to actual loan documents that we got when we look at the geo the amount we borrowed in a short term loan, in this case, cash paid on long term notes, does that add up to the cash we paid? When we financed the equipment or the or the cash we actually paid on the notes and then cash received from issuing stock 45 and the dividends We can see that we have some of the additional information which check these amounts on here on the income statement, then we have it says that we borrowed short term loan 5000. That looks good paid to reduce the long the long term loan 47,500. And that now 47,000 to 500 is where we’re at there. So that’s going to be another one of our major kind of check figures to look through that.

17:27

So it looks like everything ties out. Now we’re going to take this and we’re just basically going to going to eliminate the adjustments and be left with just this. So we’re just going to say, Okay, now, we can hide this information, and be left with our ending numbers, which would look like something like this. So again, this is more of a kind of a worksheet because we could go through here and fix up and trim up the terminology, and whatnot. But that’s a kind of a worksheet process that can get us through this through this process in such a way that we can do it in a step by step basis and cash flow statements similar to like a bank. When we get to the end of it, oftentimes it’s not imbalanced and no one knows how to fix it except to start all over again. Well, this process will hopefully give us a process that we can not have to start over again and have some check figures along the way.