In this presentation, we will continue on with the statement of cash flows. Looking at the financing activities looking at cash borrowed on notes, we’re going to be using the information with our comparative balance sheet, the income statement and the additional information focusing on the comparative balance sheet. First, it will be used to create this worksheet, we have going through this worksheet looking for all the differences and finding a home for them starting Of course, with cash down here, and then we kind of skipped around to pick up all of the cash flows from operating activities. And that’s really how people usually start this thing out. And rather than going just from top to bottom, picking out the operating activities, then we went back and we picked up the cash flows from investing activities. Now we’re going to go down and pick up the financing activities. And those deal with notes payable here. So we have the notes payable, and we have this common stock issuance. So those are going to be things that are typically going to be in the final financing. And you might think of as well, how would I know this? What? Why would I know that’s going through? Well, if we go through these, remember that the cash is obviously down here, that’s where we started. And then the current assets versus current liabilities, most of them are going to be up here. And that’s going to be the accounts receivable, the inventory, prepaid expenses, and then equipment.

01:21

We had to we had to jump down we had to think about it and the test would have would normally be I mean, you’ll get used to just knowing where these things will go after time, but would be Is there a journal entry? What’s the journal entry, if there’s a journal entry that’s related to an income statement account, a primary portion is related to an income statement account, then it probably probably belongs in the cash flows from operations. Most of the cash flows will be from operations because that’s what we do. So this is probably going to be the largest section. That’s why we spend the most time concentrating on it. If we go through the journal entries, and we don’t see any major income statement account, then it’s probably the case That it’s either investing or financing. If we purchased something as we did with equipment an asset, then it’s going to be a form of investment. Because we’re investing we’re not financing, we’re investing we might have financed the equipment with a loan. And that’s going to be part of the transaction. But the actual purchase of equipment, the cash related to it will go here. And so and then when we went through the accounts payable, and then the notes payable, we start thinking, well, a notes payable, you probably just hear it and say, huh, that probably sounds like it’s not operating is probably financing or investing it’s going to be financing.

02:39

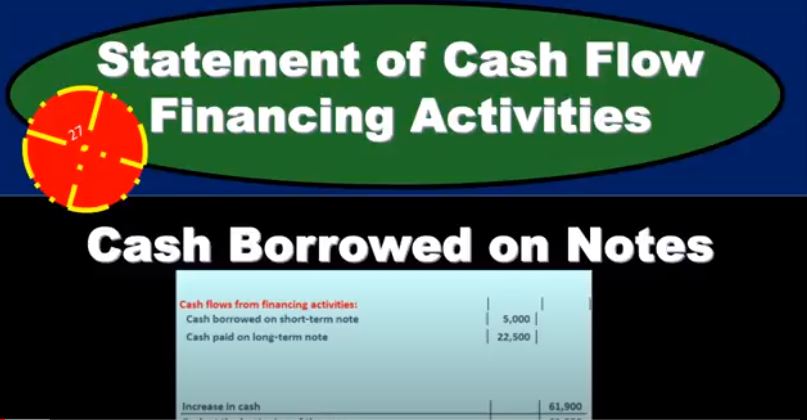

You can also think that through with the with the journal entry, what would be the normal journal entry. For note, well, we would debit cash, probably we got cash, and we’re going to credit a liability notes payable, and there’s no income statement account related to that. The other side of that is when we pay off the note which we would credit cash and debit the note, now interest might be involved in there. But that’s not going to be the major component of the financing of the note. So it’s therefore not an operating activity. It’s not kind of part of the income statement, the major portion of the notes, not an income statement. So it’s not an operating activity. And we’re not buying anything necessarily, if we just took a loan out, if we got money, cash and credit a liability, then so therefore, it’s not going to be in the investing activities. Now we might have financed the equipment. And if we do so, if we finance the equipment, then no cash flow is involved. And we’ll have to deal with that. But if we just borrowed cash, then it would be down here in the financing activities. So in this case, we’re saying okay, the short term note payable went from 10,000 to 15. It went up. So that would mean that you would think that we borrowed cash So you would think that that would be a borrowed cash. Now again, there’s not going to be a lot of loans or a lot of loan activity.

04:07

Because it’s not something we do every day, we’re not going to, it’s not going to be like the cash account where there’s a ton of activity in the general ledger, we borrow loans every, every so often, we pay them off periodically, typically monthly, or more so than monthly. So there’s not going to be a lot of activity in the general ledger for the loans. But it’s probably more complicated than just we took out another $5,000 loan. It might be that simple. But it might be more complicated, we might have multiple loans that were grouped together in this loan account. Or we might have some more that we took out and we made payments. So it could be more complicated than this. But I don’t want to go we don’t want to go through the GL at this point in time and make that more complication. We just want to put the number here now and then break out that difference so that we can still reconcile the same goes for this loan. This loan went from 77 500 to 100,000. So it went increase, you would think that we borrowed more money. Again, I put here cash paid, because at the end of the day, we’re actually going to flip to paying cash once we make our adjustments.

05:11

So probably should have started here saying I would assume it would be a borrowing. And then if something changed it, then we’d say paid, why would it change? Because there’s other things, there’s some other things that’s going to be happening with the detail. And with loans. And with things like equipment, that’s typically going to be the case we’re gonna have to dig into the GL, and look at those few transactions related and see what really happened to them. The point right now, however, is that whatever cash happened with the loan is going to be a financing activity. And we want to put it in the financing activities. And before we get in there and break out all the detail, we just want to use these two numbers first. So that we can reconcile we can reconcile to this cash flows number here, once we reconcile once we have a Everything recorded all the tools, everything on the table, then we can go back and dig through the jails. And look what actually happened on these loans and see how many loans there are, what happened with them, and break out in a systematic way in a way that will still be imbalanced. And what we’re really trying to do is say, here’s the 22,500, we want to see, we want to break that out, but still break out this difference, whatever we break it out to should add up to 22,500. And we’ll be okay. So we want to but I want to first make sure that we’re in balance, and then do that. And and that’ll be an easier process.

06:35

Now, what are some things we’re going to look for? When that happens? We’re going to go through the geo, and we’re going to look for any loan that happened. And we’re going to say what happened here? Is it just a line of credit? We just pull out another 5000 line of credit that we’re going to pay back in the future? Or is it more complex than it? Did we make payments on it? Possibly did we purchase equipment and finance equipment that’s going to be more complex? Why? Because we didn’t really pay cash. I mean, there’s no cash happening there. There’s no deadline. or credit to cash. If we bought equipment and financed it, there’s no cash flow. So if that’s the case, we’re gonna have to deal with that. And that’s often the case when equipment, for example, increased up here. And, and we have a loan happening here. So it looks like there could be a financing option that we bought equipment didn’t get the cash, and therefore it’s not really a cash flow item. We’re going to have to deal with that and go through that. So those are the types of things we’ll take a look at when we do these adjustments.