In this presentation, we will put together a worksheet that will then be used to create the statement of cash flows using the indirect method. To do this, we’re going to use our resources which will include a comparative balance sheet, and income statement and added information. Remember that in practice, we’re typically going to have a comparative balance sheet RS here being for the current year 2005 and 2000. x for the prior year. So we need a comparative to time periods in order to create our worksheet. This will be the primary components that we’ll use to create our worksheet. We will need the income statement when I’m creating the statement of cash flows mainly to check up on some of the differences that we will have in our worksheet. And then in a book problem will typically be told some other things related to for example, purchases of or sales of equipment, borrowings, if we had any cash dividends or any dividends at all, this is added information we would Need. In practice, of course, we would just be checking on these things by looking at the difference and going back to the GL. And just taking a look at those differences in order to determine if we have any added information that needs to be adjusted on our statement of cash flows.

01:15

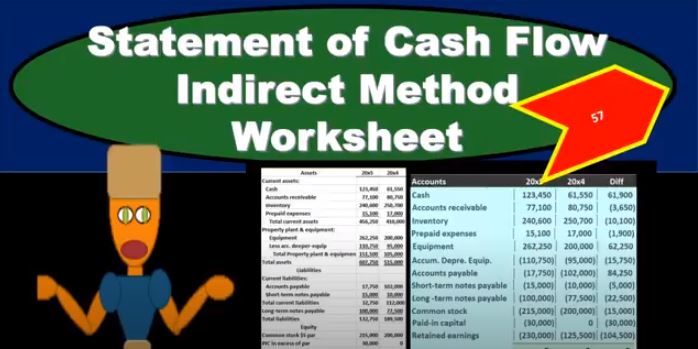

So now we’re going to take our difference in the comparative balance sheet and create our worksheet. Now, some people will just take this comparative balance sheet and just take the difference between it. But it’s easier to kind of put it into a worksheet and to put it into more of a trial balance worksheet. In other words, to put it into a post closing trial balance type worksheet, so I’m going to do the opposite of what we typically do when we create the balance sheet. And that is to take it from a plus and minus balance sheet as we see here, to a debit and credit format, trial balance. So we’re going to, we’re going to take everything that we have here the end result, and we’re going to try to convert it into like a trial balance type of result. By doing that, it’ll be a lot of easier for us to do the calculations on the worksheet, what we’re going to do is have a plus and minus or a debit and credit type worksheet, which will make it easier for us to do the calculations. And we’ll eliminate some of these subtotals. We don’t need this total current assets. We don’t need the subtotal for property, plant and equipment. Total Assets, we don’t need the current liabilities or total liabilities. So we’ll remove those Subtitles by making the worksheet. So we’re just going to go line by line. And again, we’re not going to start with assets, we’re not going to start with current assets, we’re just going to start with the account of cash. And we’re going to say okay, 2000 x five 123 450 and 2000 x 461 550. And then of course, we will subtract those two, and we’ll get to the difference, the change the change here being the 61 900, which is going to be this number minus this number. The change is increasing, of course, because we can we can see the change.

02:55

And as we go to debits and credits, we kind of gotta just interpret the change and see what happens. Of course, this is the prior number, here’s the current number. That means it went up, this change is an increase, but we’re representing these kind of in debits and credits. So we need to be careful to make that conversion. So then we’re just going to go to accounts receivable, same thing, we’re just going to pull these over into our worksheet, the 771 hundred and 80,007 52,000 x four and x five. If we subtract the two out there, we’re going to add the difference here. And that’s going to be 3650. In this case, of course, it went down, we decreased in this account, then we’re going to have the inventory so the inventory is another asset. We’re just pulling over these two numbers started at 240,600. Or it started at 250,700. went down to 240 600 decrease of 10,100. And then we’re going to go to prepaid expenses. We’re just going right down the line here was that 17,000 now at 15, one, decrease 1900 then we’re going to skip down to equipment, we’re going to, we’re not going to add the subtotals or another subcategory, we’re going to go down to equipments and other assets start at 200,000 went up to 260 to 250, change 62,002 50. Then we’ll go to the accumulated depreciation a little bit tricky because it’s a credit balance account a contra asset account.

04:19

So when we convert it from a plus and minus to a debit and credit, I’m going to put brackets around it here to represent the fact that it’s going to be a credit. So it started at 95,000 went up to 110 750. This 15,007 50 is an increase because it’s it’s an increase in the credit direction. So you got to be kind of careful when we look at these worksheets to set it up and make sure we understand what the signs are saying. And the only way to get good at that is just to practice keep on doing the worksheets so you can get good at knowing what’s the difference between a debit and credit and a plus and minus and how can we use the two and still use math without without getting the two concepts confused? And the cash flow statements are really good for learning that because no matter how you set it up, we gotta we gotta get those differences down. And then we’ve got the accounts payable. So same thing, these are liabilities now. So it started at one or 2000, and it ended at 17 750. So that’s a decrease. So it decrease it in the debit direction at 4002 50 went down in this case, then we’ve got the short term payable started at 10,000 went up to 15 increase with a credit of 5000. And then we have the long term started at 77. Five, increase this to 100,000. Increase 20 to five common stock. So note we’re skipping the subtotals not adding the subtotals we’re down to the common stock. It started at 200 It’s a credit again, so we’re converting these these common stock to a credit 200,000 ended at 215 increase in the credit direction 15,000 and then we’ve got additional pages capital from here, started at zero went up 30. So that’s a change of 30 increase, and then we’ve got retained earnings. So here’s retained earnings, it’s a credit to it’s in the equity section 125 500 went to 230,000, increased by 104 thousand 500. And again, we’re not going to have the subtotal here, so that’s going to be the entire thing. Then we can easily see if we did this correctly, by if we have the Excel if we have the positive numbers, or if we just add these up, if we have the debits being positive and the credits being negative, we take the debits minus the credits, and if they’re equal, then we’ll end up with zero. And that’s going to be the beauty of this worksheet, of course, because we can easily see that well, if we’re starting with something that ended up debits and credits equals zero, and we’re ending with something that the debits and credits equals zero.

06:53

And then we’re taking the difference going the same way each time, which we can do in Excel with just a formula We can do it with a calculator. And then we know that the change will equals zero. Now, this worksheet if you just if you spend some time with this worksheet, it’ll give you a good understanding of where we’re going to start with the creation of the statement of cash flows. So here’s kind of an end result type worksheet of the statement of cash flows, we’ve got the cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, we’re going to start this process by basically just looking at each of these differences and finding a home for them in the statement of cash flows. And you can think of it just as a puzzle at this point in time, we know this, we know that the difference right here 61 nine is going to be represented as the increase or change here, and we know that these two obviously these two cash numbers are going to get to the difference here. So this is going to be our ending cash at the end of the time period. We’re really this is kind of like the bottom line though. This is really kind of the bottom line because That’s the change, that’s what’s happening to cash, that’s going to be the change in cash.

08:04

So we already knew that the end result, because it’s on the balance sheet. The reason we want to get to it on the statement of cash flow is simply so that we can tie it out to the balance sheet. But this amount of time out to the worksheet is given us that change. And that’s really kind of what we’re looking for. When we’re looking at the statement of cash flow. It’s an activity statement. So we know that that is going to be the bottom line. And we know that this whole thing adds up to zero if I was to add up all these changes. So that means that if this is the bottom line, then if we find a home for everything except that then the difference is going to be this meaning if I was to say this minus this, or you know, if I was to add up this whole column, debits minus the credits or the positive numbers minus the negative numbers, then it would add up to the 61,900. We know that has to be the case because we can just see it mathematically that has to work. So all we need to do to start the statement of cash flows is to take all these changes that we have Find a home for them here and a plus and minus format. So we’re just reformatting these numbers, just putting them into a different format.

09:08

So that’s all we really have to do. Now it is a little bit more complex from that I would do this in a two step process. And this is what I’m going to argue to do is to first find a home for all these without getting into any more detail without looking at the added resources of the problem, just so you start with something that’s in balance, and then go back and look at the additional information and make changes. So I would argue to do that in a two step process in a problem like this. Let’s figure this out. Let’s find a home for these. And then any added information that makes these more complicated. We’ll get into the detail. Why would that happen? Like for example, if the equipment here or let’s say the accumulated depreciation, the change in accumulated depreciation should be depreciation expense right here, but notice it’s not. And if we went in if we went to the balance sheet Or the income statement we would see is that the change is not exactly what the depreciation expense is, as we would expect. And so what we would have to do is figure out what else happened, there must have been a sale of equipment or something like that, that resulted in that change being different. And we’ll have to go back and deal with that. But I would argue that first we’re just going to put this in the change for the depreciation, and then go back and figure that out.

10:24

Because when we figure out the detail, what we’re really doing is taking this change, and we’re breaking it out into multiple categories. And we’ll end so that’s going to complicate things. So it’s easier to kind of figure the thing out, make it make it work with just these numbers. Knowing that you’re going to have to give more detail to some of them, they’re not completely correct, and then break out the ones you need to as you as you recognize them as we go. That’ll be the process. We will use.