Corporate Finance PowerPoint presentation. In this presentation we will discuss a pro forma balance sheet or budgeted balance sheet. Get ready, it’s time to take your chance with corporate finance pro forma balance sheet. As we think about the pro forma or budgeted balance sheet, let’s take a step back and see where it fits in with our projections with our pro forma statements, you’ll recall that the place we need to start then is going to be the sales projections, we need the sales projection, we’re first going to think about how far we’re going basically the activity type of statement. And then we’ll take that change that activity statement how far we went, like miles driven in and our income statement, and then we’ll tack on the beginning balance where the odometer was at at the beginning to get to the ending point, which is going to be the ending balance sheet.

Posts with the Cash tag

Cash Budget 415

Corporate Finance PowerPoint presentation. In this presentation, we will be discussing the cash budget Get ready, it’s time to take your chance with corporate finance, cash budget, as we consider the cash budget, let’s take a step back and think about the budgeting process. So we can think about where the cash budget will fit in it. So we got to start off with the sales projection, that’s going to be our first step. So we can think about the production plan if we manufacture inventory, or we think about the purchasing plan. If we purchase and sell inventory, then we can think about the pro forma income statement. Now the pro forma income statement is going to be on an accrual basis. But we also want to be considering the cash budget. So obviously, once we have once we start to construct the income statement, on an accrual basis, we can also think about what the cash flows will be.

Statement of Cash Flows 235

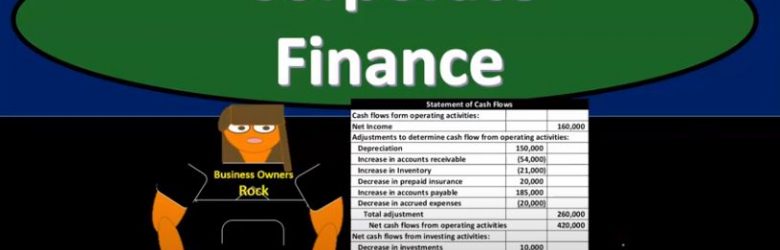

Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

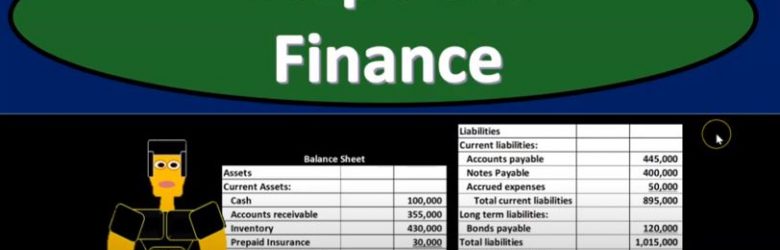

Balance Sheet Continued 215

Corporate Finance PowerPoint presentation. In this presentation, we will go into more detail about the balance sheet. Get ready, it’s time to take your chance with corporate finance, balance sheet continued. Remember when we’re thinking about the financial statements, we can break them out to two separate objectives. If we’re considering this from an investor standpoint, that is, where does the company stand at a point in time, and what’s the likelihood or their earnings potential in the future, which we will typically based on past performance, therefore, you’re going to have the timing statement and the point in time type of statement. So when we think about the balance sheet, that’s going to be the point in time type of statements. So if you’re looking at the financial statements for the year ended December 31, the balance sheet will be as of the end of the period, in this case, December 31, as opposed to the timing statements, which are going to be the income statement being the primary statement that should come to mind measuring performance, which will be as of January through December 31 measure and how well we did for that range of time. So our focus over here is going to be on the balance sheet.

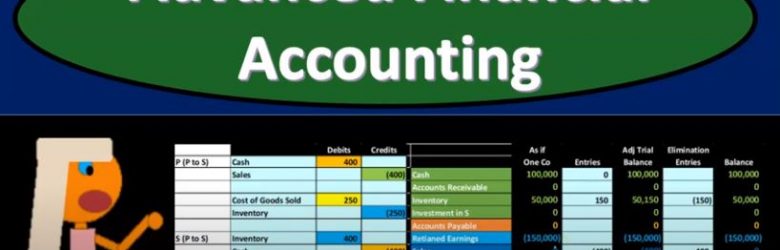

Sale From Parent to Sub Sub Has Not Resold

Advanced financial accounting PowerPoint. In this presentation we will discuss a situation where there is a sale of inventory or transfer of inventory from parent to subsidiary, the subsidiary not having yet sold the inventory. So in that sense, we have an intercompany type of transfer. When we consider the parent and subsidiary as a whole with regard to a consolidation process, the parent sold to the subsidiary the inventory, the subsidiary still holding on to that inventory has not resold it externally at this point, get ready to account with advanced financial accounting. What we want to do now is think about the transaction on p side and then on SSIS, and then what the elimination entry will be. So there’s a couple ways you can think about this, you can kind of memorize what the elimination process will be what the elimination entry will be and put together worksheets to do that elimination process kind of by just routine by just filling out the worksheet. And then you also want to analyze the worksheet and think about it in detail in terms of what is actually happening.

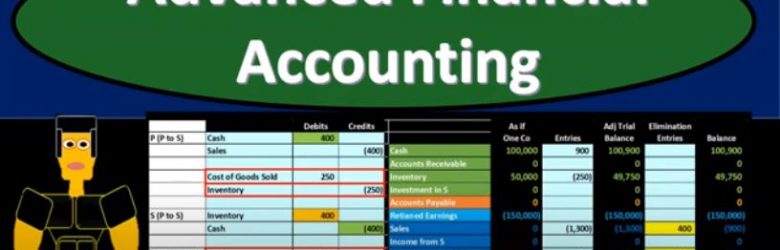

Parent Sale to Sub & Sub Resold

Advanced financial accounting. In this presentation we’re going to discuss an intercompany transaction where a parent makes a sale to a subsidiary and then the subsidiary resells it. In other words, we have this intercompany transaction, we want to think about how that is constructed. And then how we can do the reversing entry for it or a consolidation entry in the case of a consolidation of a parent and subsidiary in a consolidated financial statements, get ready to account with advanced financial accounting. So within a situation where we have a sale from P to s, and then S sells it to an outsider remember that as it goes to the outsider, that’s going to be the legitimate type of so that’s the arm’s length transaction, the sale from PETA is not so and therefore we kind of have to eliminate that. Now if it’s been sold to an outsider, then we have a situation where the inventory is still gone. There has been a sale being taken place. And so we so that’s good, but we still have to do the reversal of part of that intercompany transfer and it’s gonna boil down At the end of the day, basically debiting, the revenue account reversing revenue, and reversing the cost of goods sold. So this is the boiled down version. Now if you think about it, you might say what happy because if p sales to s, then you’re going to like debit cash credit, you know, you’re going to credit the sales, and then you debit cost of goods sold, and credit inventory and then asked is going to be recorded cash, and then they’re gonna be recording, then the other side go into inventory, and then right, there’s more, and then they made the sale to the outsider. So how do we boil this down? How does the intercompany boil down to just this right? We kind of kind of have an idea of that in our mind.

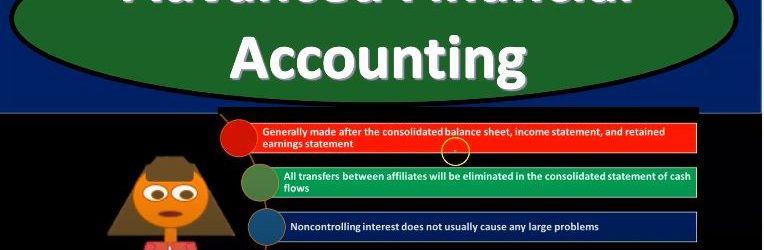

Consolidated Statement of Cash Flows

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated Statement of Cash Flows get ready to account with advanced financial accounting, consolidated statement of cash flows. So the consolidated Statement of Cash Flows we have a parent subsidiary relationship parent owning over 51% of the subsidiary therefore, we have the consolidated financial statements which of course includes the consolidated statement of cash flows. So, when we think about the consolidated statement of cash flows, we’re basically thinking about those areas where the cash flow statement will be different from a normal cash flow statement, which is one company or one business if you want to learn more about the cash flow statement, and I do recommend looking more into the cash flow statement because it’s one area where even in public accounting, oftentimes people don’t have as good a grasp on it as they could and some people are really good at reading it but don’t really understand as much of how to put it together in a room. systematic way even if there’s going to be, or especially when there’s going to be complexities to it. So we do have a course on the statement of cash flows, which we believe puts together a nice, simple, simple way in a systematic way to go through putting the statement of cash flows in such a way that, that you can do it in a step by step process. And then if you make an error, you can go back and you should be able to find that error easily and not have to kind of start the whole thing over again.

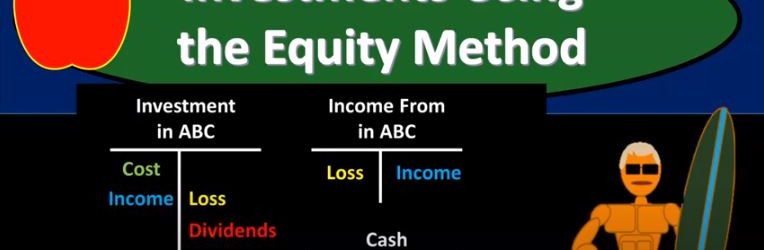

Investments Using the Equity Method

This presentation we’re going to focus in on investments using the equity method. In other words, we’re going to have a situation where we have one company that’s investing in another company, this time they have significant influence. And therefore, we will be using the equity method to account for that investment, get ready to account with advanced financial accounting. In prior presentations, we gave an overview about different accounting methods that could be used based on different levels of influence and control those general rules being that if there is 20, or zero to 20%, ownership, we use the carried value 20 to 50%, which is where we’re going to focus in on now, the equity method, idea of there being that there is now significant influence. So in other words, if we own zero to 20%, that would be kind of like you investing in a large company like apple or whatnot. We’re the assumption being, we don’t have significant influence, even though we do have a vote of what happens However, when our vote gets to be 20% Have the total, that’s kind of a shady line or not completely solid line. But that’s kind of an arbitrary line that’s been drawn, then you’re thinking, Okay, now there’s pretty much significant influence. And therefore, we’re going to use a different method equity method, then if we’re over 51%, which is a more solid line, if you have more than 51%, and you’re voting on things, and you have like more than 51%, then you pretty much win. And that would mean control for that situation typically. And then we may use a different method, such as a consolidation. So we’re going to be focusing in here on the middle method, where we have significant influence where we have that lower line that’s a little bit fuzzy that 20% arbitrarily drawn. And then if you’re over the 51%, then it’s more likely that then you do have control and may be using the consolidated method. In that case. So equity method we’re focusing in on investments using the equity method, the equity method will reflect the investors changing interest in the investi. So we’re going to try to basically reflect what’s going on on the investor side with the change investment in the investi, the company that we are investing in that company, we have a significant influence over investment is recorded at the starting purchase price.

Creating a Statement of Cash Flow-Indirect Method-Accounting%2C financial

Hello in this lecture we’re going to talk about creating a statement of cash flows using the indirect method, we will be able to define a statement of cash flows, create a statement of cash flows explain a process of creating a statement of cash flows designed to limit mistakes and define the indirect method. So what we’ll do is we’ll work through basically a problem and look through the statement of cash flows. We want to think about a few things we want to think about how to create a statement of cash flows, we want to think about a few definitions of what is a statement of cash flows, we want to kind of explain what the purpose is of a statement of cash flows and going through the process can help us to do that. Also want to point out that creating the statement of cash flows can help us with setting up a problem in such a way that we can limit the amount of mistakes that we will make. So a statement of cash flows is something that in a lot of firms, people generally often have problems to create the statement of cash flows. And it’s good practice to go in there and and create the statement of cash flows and try to create a system in which it’s easy for us to have checkpoints and see where a problem is going to happen.

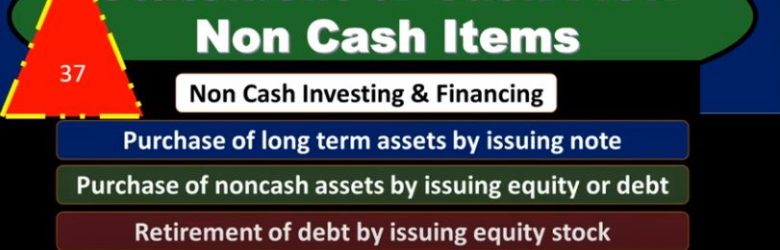

Statement of Cash Flow Non Cash Items

In this presentation, we will take a look at the statement of cash flows non cash items. First question, why would we be looking at non cash items when considering a statement of cash flows? We’re gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion, then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. So, some examples of non cash items would be the purchase of long term assets by issuing a note the purchase of non cash assets by issuing equity or debt, the retirement of debt by issuing equity stock, lease of assets in a capital lease transaction and exchange non cash asset for other non cash asset. Consider these examples and note some of the common features including the deal with investing and financing activities. and think through why we might be linking them to a statement of cash flows. We’ll go more fully through this by giving an example of the purchase of long term assets by issuing a note, an example that we can then apply out to the rest of these items. So what are we going to do with these non cash items, we’re going to report them at the bottom of the statement of cash flows or report them in a note related to the statement of cash flows. So we’re going to have to say in some format, or other, hey, look, these are some non cash items that we’re linking to, for some reason, the statement of cash flows.