Advanced financial accounting PowerPoint presentation. In this presentation we will discuss translation versus remeasurement. Get ready to account with advanced financial accounting, translation versus remeasurement methods to restate to foreign entities statements to US dollar. So the most straightforward methods can be translation of foreign entities functional currency statement to US dollars. So the translation is what we’ll use the most straightforward method when the entity statement is using the functional currency. So typically, if the if the entity is using the functional currency, and we need to translate it, then we’ll simply translate it from the functional currency to the US dollars. And then there’s remeasurement of foreign entities statement into its functional currency. So remeasurement means that the entity is running their bookkeeping in a currency that is not the functional currency. Right? So then we’re going to have to re measure we’re going to use this term re measure rather than translate the To the functional currency, so after we remeasure to the functional currency, after remeasurement statements need to be translated to the reporting currency if the functional currency is not the US dollar. So in other words, if we’re assuming, in this case, in the case of the remeasurement, or let’s say, we have an entity that we’re going to be consolidating a subsidiary entity in another country, and we’re in the US and we need to basically consolidate these data together in terms of US dollars at the end of the day, if the entity is using the functional currency as as their financial statements, their bookkeeping is in the functional currency, then we can simply use the term translate it to the US dollars, which will be the parent currency that we’re talking about here. If however, the foreign entity is having their books in some currency, that is not the functional currency, then what we’re going to have to do is re measure it. We want to use remeasurement To the functional currency, we want to make remeasure at first to the functional currency rather than straight to the US dollar. So we’re going to use remeasure to the functional currency. And after we re measure to the functional currency, if the functional currency is the US dollar, then then we should be able to stop there. That’s okay. If however, the functional currency is not the US dollar, then we would have to go from the functional currency and then translate to the US dollar. So we’ll talk a little bit more about that as we go. So let’s think about translation.

02:32

First, let’s go into that a little bit more depth is what’s going to be used most of the time because you would you would imagine that if you had a foreign entity, a subsidiary that you’re going to consolidate possibly, with the statements of the parent company that’s in US dollars, you would think that the functional currency of the foreign entity would either be, you know, possibly the US dollar or if it was related to the parent company more intimately or if it’s more independent, you would think that the functional Currency would then be the foreign currency and in the market they are in in itself the foreign currency was the functional currency, then we could just go straight to the the translation of the financial statements which are in the foreign currency basically to the US dollar. So, translation then would be the most common method used in this in this process use when foreign entities record recording currency is the foreign entities functional currency. So, once again use when the foreign entities recording currency what they keep their books in on is the foreign entities functional currency that is there functional currency which we talked about last time.

03:38

That means that we could simply do the translation to the parent company currency the US dollar current rate will be used to convert recording currency asset and liability accounts to the US dollar. So, the current rate meaning the rate as of basically the end date on the balance sheet, which of course again makes sense because we’re talking about assets and liabilities basically balance sheet accounts. And you would think it would make sense pretty much to be using the, you know, Indian balance sheet date. for them. current rates are also used to convert recording and functional currency balance sheet account balances to US dollars. The average rate for reporting period will be used to translate revenues and expenses. So when we translate the revenues and expenses, it would kind of make sense that we have a timeframe, a beginning and an end now. So we’re going to look for an average rate that will give us an approximate rate for that time frame, as opposed to basically the rate as of the end of that timeframe. Translation adjustments will be a component of the comprehensive income. So we talked about that is one of the questions we’re going to have if there’s going to be some kind of adjustment related to the translation adjustment because especially if we if we end up using obviously we have the different rates here, that we could be using the balance sheet date rate, and then an average rate, well, then we could end up with with a different Then where are we going to put that? Do we put that on the income statement or where does that go, we’re going to put the translation adjustments will be a component of the comprehensive income. So current rate method is the name of this method. And then we get into the remeasurement. So now we’ll talk about remeasurement. As opposed to once again, translation translation was what we went through now we’re talking about remeasurement remeasurement of the foreign entities financial statements from the recording currency used by the entity the recording currency used by the entity in their books into the foreign entities functional currency. So now we’re talking about a situation where they’re, the currency that they’re using for their books isn’t their functional currency, which we determined what the functional currency was by looking at some of the factors in the prior presentation. So once again, restatement of the foreign entities financial statements from the recording currency, what they record their books in use by the entity into the foreign entities functional currency, whether that be us dollars or not remember, of course, the ultimate goal is to get to US dollars so that we can then combine them if we have to do a consolidated reporting with the parent company, but we have to do this remeasurement process First, use only when the functional currency is not the same as the recording currencies used to record the books and record records of the foreign entity.

06:22

So that’s it’s not as common right because it’s used only when the functional currency is not the same as the recording currency used to record the books and records of the foreign entity. Temporal method is the name of this method. Continuing on with the remeasurement process while we’re on remeasurement, the current rate is used to remeasure monetary balance sheet items. So we’re going to use the current rate which is the end rate on the balance sheet. The historical rates are used to remeasure non monetary balance sheet items like fixed assets, inventories, long term investments. So note that here we’re using the historic rate. And that’s again, you can kind of make an argument for that. Why? Why would we use the historical rate? Well, that’s the rate at the point in time that we had these large purchases, possibly with if you’re talking about large items like like fixed assets and one top long term investments, so historical rate, then use there, then the average rate is used to remeasure revenues and expenses. So now we’re on the income statement where the end date, the rate at the end of the time period doesn’t seem appropriate, it seems like we should be using a rate that would be more reflective of the time frame, instead of just the end of the period. So we’re going to use some type of average in that case, and then the imbalance adjustments needed due to these applications will be included in the income statement as a remeasurement, gain and loss. So notice here on the remeasurement, you’re going to have a difference here. Why? Because you’re remeasuring using we got three different rates here that we’re using to remeasure the financial statements that were in balance, right and so there’s going to be an adjustment and again, we’re where does it Going to go this adjustment, we’re going to put a gain or loss due to the remaining payment. Well, here we are, we’re going to put the imbalance adjustment needed due to this application will be included in the income statement as a remeasurement gain or loss. We’ll actually call it label at that, but it will be on the income statement.

08:16

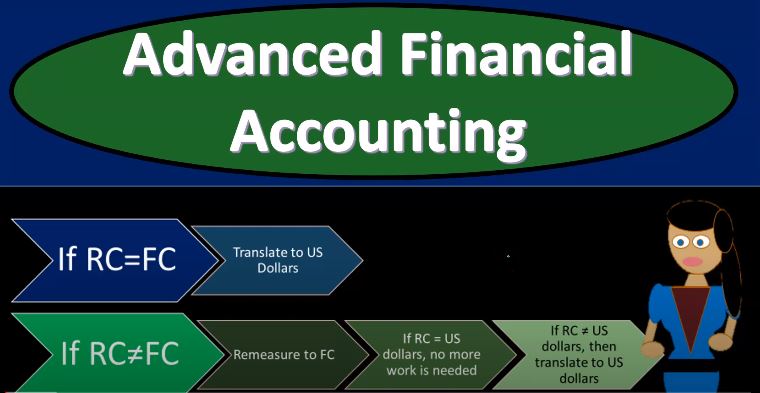

So let’s take a look at a couple scenarios. Just to just to think about this a bit further scenario one, recording currency is the functional currency. And you would think this would kind of make sense you’ve got a subsidiary or a US parent company, we’ve got the subsidiary in a foreign country with has foreign currency. And if they’re, if they’re more operational over you would think then the recording currency would be the functional currency, right? And if so, if their functional currency is the foreign currency, then you would think they’re recording currency, what would be the what they would be using as well be their functional currency, so that would probably be the more common case. And in that case, it’s going to be an easier kind of process because we would then just try translate the functional statements. So we look at their statements that are in the foreign currency, which is the functional currency, it will just going to translate from the functional currency to the reporting currency, which we’re assuming, in our scenario is the US dollar, right? So it would be a pretty straightforward process. We say, yeah, there’s their financial statements, the financial statements aren’t Well, in theory, it’s a straight, it’d be a long process. But at least we don’t have to do two translations. In that case, we can just say, hey, look, it’s Yeah, that’s their functional currency. It’s in the place that they’re at. That’s what the financial statements are in. Let’s work on then just straight translation. And we’ll have to go through the process of using whatever rates, the rates that we looked at in order to do that translation process. So it’s not an easy process. But at least it’s a one step translation and not the remeasurement involved in it as well. So no more steps are needed, because the consolidated and financial reporting can now be prepared in the reporting currency. So we’ll just have to do that one translation, so it looks something like this. For scenario one. We’ve got the record currency is going to be equal to the functional currency. So when the recording currency is equal to the functional currency even though it’s not the US dollar it’s or may not, right? It’s we’re saying that’s going to be some foreign currency that the recording currency is equal to the functional, then we’re simply going to translate. And then we have, we have them the recording currency. Okay, let’s take a look at scenario two. Now the recording currency is not the functional currency. So they’re doing their financial statements in a recording currency. They’re bookkeeping, in a currency that’s not the functional currency. However, the functional currency is the reporting currency. So in that case, what we have to do is re measure the financial statements from the recording currency to the functional currency.

10:42

So now we have to do to re measure meant thing from the recording to the foreign to the functional, but no more work is needed from that step. Since the consolidation and financial reporting reports can now be prepared into functional currency because it is the same as the reporting currency. Right. So now we have a situation Where the recording currency is not the functional currency. So it’s a foreign company, they’re recording their currency in something impossibly the foreign currency. But possibly that’s not their functional currency, we’ve determined that their functional currency is actually the same currency as the US as the US company, the parent company, which we’re saying is the US dollar. Well, in that case, then we still kind of have like a one step process, but that one step process isn’t translation, but rather remeasurement, we’re going to do remeasurement. But after we do the remeasurement, that’s all we have to do, we don’t have to then translate again. Because once we re measure now, their functional currency is the reporting currency, which we’re saying is the currency of the US dollar. We have the US of A parent company, which we’re saying in this example would be the US dollar. So still not too complex of a process, but a little bit a little bit different due to that change. So here we go. Scenario two, we have the recording currency, which we’re going to remeasure use remeasurement To the functional currency, and then the functional currency is equal to the reporting currency. So then we can just push forward from that point, scenario three. Now we’re talking this is the most difficult scenario here. This is the tough one, the recording currency is not the functional currency. And the functional currency is also different from the reporting currency. So now we’re talking about the recording currency, whatever they’re recording their books in is not the functional currency. It’s not It’s not what we determined their functional currency to be. And we talked about the factors that in the prior presentation, what does it mean to be the functional currency? How can we determine what their functional currency is, and the functional currency is also different from the reporting currency. So in other words, we’re thinking of ourselves as we’re the parent companies in the US, we have another we have another subsidiary somewhere else, the recording currency is not the functional currency. So if the functional currency was the currency where they’re located, for some reason, they’re recording their books in a currency. That’s not backed And you would think then that the currency they would be reporting, and would be the US dollar would be their functional currency, even though they’re like located somewhere else. But no, it’s not. And therefore, if that were the situation, the functional currency, we’d have to do kind of a two step we’d have to do both the remeasurement and, and then the translation. So let’s take a look that we remeasure the financial statements from the recording currency to the functional currency.

13:27

So whatever currency they decided to record the books in for whatever reason, we’re going to remeasure that to the functional currency, which we determined we know how to determine that from the prior presentation. And then if the functional currency isn’t the US dollar, which is the which is the currency of the parent company that we need to get to, so that we can do the consolidation process, then we’re simply now that we have it in the functional currency, we’re going to then translate the financial statements from the functional currency to the reporting currency, which we’re assuming is the US dollars. This will allow the consolidation And financial statements to be prepared in the reporting currency. So again, we’re having the recording currency that needs to be re measured to the the functional currency. And then it’s a functional currency. So once again, though recording currency wasn’t the US dollar and other recording currency wasn’t the US dollar, and it wasn’t their functional currency, and then we remeasured it to the functional currency, which still wasn’t the US dollar, which is the currency of the parent. So then we have to translate it to the reporting currency, and then we’re good to go. So this would be a more or less likely scenario. So in any case, but the more complex one so the summary if we summarize this in like an if then kind of flowchart type function, we’re going to say that the RC equals the recording currency and FC equals the functional currency. So if the recording currency by the company we have a we have a subsidiary in a foreign country, we’re saying that they’re recording currency currency is The functional currency, then all we need to do is translate it to the US dollar. Obviously, if the recording currency is their functional currency and it is the US dollar, then there’s no problem. Because you know, that’s that’s not a problem. But if the recording currency is equal to the functional currency, and it’s not the US dollar, then we simply just need to translate it, so we got to just translate it to the US dollar. But if the recording currency is not equal to the functional currency, then we’re going to have to remeasure to the functional currency. And then if the functional currency equals the US dollar, then there’s no more work that needs to be done. We’re just gonna re measure. So instead of doing translation, we do the remainder, but then we’ll be in the US dollar and we’re done. However, if the functional currency is not equal to the US dollar, then we have to take what we just did the remeasurement to the functional currency and then translate it to the US dollar.