Receive Payment & Make Deposit 7200 Accounting Equation – Excel

In this guide, we’ll explore the accounting equation through practical examples, including handling payments on accounts, managing clearing accounts, and ...

Read More

Read More

Pay Employees Form 1520 Accounting Equation – Excel

Welcome! Grab some coffee and get ready to learn the foundations of accounting using the accounting equation and an Excel-based ...

Read More

Read More

Void Check Prior Period Adjustment 1280

If you're diving into accounting, it's essential to understand the foundational principles, starting with the accounting equation. Today, we'll break ...

Read More

Read More

Accounts Payable & Subsidiary Ledger 6360 Accounting Equation – Excel

Welcome to the foundational lesson in understanding the accounting equation and how it integrates into real-world applications using Excel. We'll ...

Read More

Read More

Create Worksheet Part 2 1028 Accounting Equation – Excel

Are you ready to build the foundation of accounting knowledge using Excel? Grab a cup of coffee, and let’s dive ...

Read More

Read More

Create Worksheet 1025 Accounting Equation – Excel

Welcome to this comprehensive guide on how to use Excel to practice the accounting equation! Whether you're an accounting student, ...

Read More

Read More

Confidence Interval – Binomial Distribution Survey Example 1970 Statistics & Excel

In this post, we’ll dive deep into using Excel to analyze survey data with confidence intervals, particularly focusing on a ...

Read More

Read More

Confidence Interval t distribution when Standard Deviation of Population is Not Know 1967 Statistics

Welcome back, number-crunchers! Grab your favorite cup of coffee because we're diving deep into statistics—specifically confidence intervals using the T-distribution ...

Read More

Read More

Central Limit Theorem – All Possible Samples Example 1921 Statistics & Excel

Welcome, and grab some coffee—statistics is on the menu! Today, we’re diving into the Central Limit Theorem (CLT) and exploring ...

Read More

Read More

Hypothesis Testing t Distribution 2 Tail- STDp Not Known 1986 Statistics & Excel

Introduction In this tutorial, we'll go through a two-tail hypothesis test using Excel's T-distribution. This approach is relevant when the ...

Read More

Read More

Hypothesis Testing 1925 Statistics & Excel

Statistics play a crucial role in decision-making processes. Whether you're evaluating trends in business, conducting scientific research, or just analyzing ...

Read More

Read More

Partnership Income Allocation Part 1 20

In this blog, we’ll discuss the process of allocating net income among partners within a partnership agreement. Our example will ...

Read More

Read More

Dice Central Limit Theorem Example Part 1 1856 Statistics & Excel

The Central Limit Theorem (CLT) is a cornerstone concept in statistics. It states that the distribution of sample means approaches ...

Read More

Read More

Central Limit Theorem – All Possible Samples Example 1920

Grab your coffee, get comfortable, and prepare to dive into the fascinating world of statistics. Today, we're tackling a cornerstone ...

Read More

Read More

Perfect Negative Correlation 1719 Statistics & Excel

When analyzing data, one key concept to understand is correlation—the relationship between two datasets. In this blog, we'll explore the ...

Read More

Read More

Statistical Inference – Questions of How Close & How Confident 1306 Statistics & Excel

Statistical inference is the art and science of using data from a sample to estimate or test hypotheses about a ...

Read More

Read More

Standard Deviation – Measuring Spread 1406 Statistics & Excel

Welcome to the fascinating world of data analysis! Whether you’re a seasoned statistician or a curious beginner, understanding how to ...

Read More

Read More

Getting a Picture – Data & Distribution 1120 Statistics & Excel

Understanding and interpreting data is crucial, whether you're a government analyst, a business professional, a researcher at a university, or ...

Read More

Read More

Probability Distribution Models and Families 1506 Statistics & Excel

In previous discussions, we've explored how to describe datasets using both mathematical calculations (like the mean or median) and visual ...

Read More

Read More

Audit Accounts Payable & Accrued Expenses 11050 Auditing

Introduction In this presentation, we'll delve into the auditing process for accounts payable, with a specific focus on accrued expenses ...

Read More

Read More

Risk Assessment Process 4020 Auditing

In this presentation, we will discuss the risk assessment process, a crucial component of the auditing procedure ...

Read More

Read More

Binomial Distribution Formula and Chart 1556 Statistics & Excel

Take a deep breath, hold it for 10 seconds, and prepare for a smooth, soothing exhale. Now, let’s dive into ...

Read More

Read More

Poisson Distribution – Potholes in Road Example Part 2 1546 Statistics & Excel

Welcome to Part Two of our exploration into Poisson distribution with Excel, where we’ll apply statistical methods to understand pothole ...

Read More

Read More

Poisson Distribution Formula 1520 Statistics & Excel

Before we dive in, take a deep breath and hold it for 10 seconds. As you exhale smoothly and soothingly, ...

Read More

Read More

Calories Data Statistics Sample Example 1361 Statistics & Excel

Got data? Let's dive into it using statistics and Excel. Although we're discussing this in OneNote, Excel will be our ...

Read More

Read More

Perfect Negative Correlation 1719 Statistics & Excel

Let's dive into the fascinating world of statistics and Excel to understand perfect negative correlations. This blog will guide you ...

Read More

Read More

Qualified Business Income Deduction Example 6785 Tax Preparation 2023-2024

Get ready and grab some coffee because tax season is a time to test out our math skills and sometimes ...

Read More

Read More

Child & Dependent Care Expenses Credit – Do You Have Household Employees 8535 Tax Preparation

Get ready to dive into the intricate world of income tax preparation, specifically focusing on child and dependent care expenses ...

Read More

Read More

Residential Rental Property – Rental Income and Expenses – Rental Expenses Part 2 9034 Tax

Welcome back to our series on income tax for 2023-2024, focusing on residential rental property. Grab some coffee, as we ...

Read More

Read More

Reporting Rental Income, Expenses, and Losses – Overview 9150 Tax Preparation 2023-2024

Welcome to your guide on reporting rental income, expenses, and losses for the 2023-2024 tax year. Grab some coffee because ...

Read More

Read More

Reporting Rental Income, Expenses, and Losses – Casualties & Thefts 9153 Tax Preparation 2023-2024

Tax season can be as daunting as facing a flock of crows on a cornfield, especially when it involves reporting ...

Read More

Read More

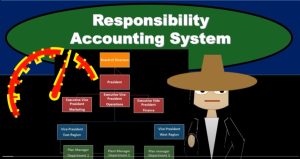

Responsibility Accounting System – Managerial Accounting

In this presentation, we delve into the concept of responsibility accounting systems. When implementing a responsibility accounting system, the goal ...

Read More

Read More

Tax Calculation – Line 16 7020 Tax Preparation 2023-2024

In today's digital world, presentations are often needed for various purposes such as business meetings, academic lectures, or sharing project ...

Read More

Read More

Earned Income Tax Credit (EIC) Overview 8220 Tax Preparation 2023-2024

Grab your coffee, and let’s dive into the essentials of the Earned Income Tax Credit (EIC) for 2023-2024. The EIC ...

Read More

Read More

Child & Dependent Care Expenses Credit Overview 8520 Tax Preparation 2023-2024

Grab your coffee and let's dive into saving some money for vacation by maximizing our income tax preparation for 2023-2024! ...

Read More

Read More

Balance Scorecard 250 – Responsibility Accounting

In this presentation, we'll explore the balanced scorecard approach to performance measurement. The balanced scorecard is a strategic management tool ...

Read More

Read More

Payments 7260 Tax Preparation 2023-2024

Grab a cup of coffee and get ready to maximize your refunds for the tax year 2023-2024. We’ll break down ...

Read More

Read More

Business Expenses Bad Debts 6525 Tax Preparation 2023-2024

In the intricate maze of income tax preparation, business expenses often stand as towering corn stalks, waving in the financial ...

Read More

Read More

Other Common Expenses & De Minimis Safe Harbor for Tangible Property 6765 Tax Preparation 2023-2024

Get ready with a cup of coffee because income tax preparation for the year 2023-2024 will require some careful attention ...

Read More

Read More

Business Expenses Interest 6710 Tax Preparation 2023-2024

Are you ready to take charge of your income tax preparation for 2023-2024? With the IRS lurking around the corner, ...

Read More

Read More

Business Expense Employees’ Pay 6700 Tax Preparation 2023-2024

Welcome to your ultimate guide for maximizing your business tax refund for the 2023-2024 tax season! Grab a cup of ...

Read More

Read More

Special Depreciation Allowance – When Must You Recapture an Allowance 6569 Tax Preparation 2023-2024

Are you ready to dive into the intricate world of income tax preparation for 2023-2024? Grab your coffee and get ...

Read More

Read More

Accounting for Your Income 6455 Tax Preparation 2023-2024

Preparing for income tax season can feel like a daunting task, but with the right information and a good cup ...

Read More

Read More

Uniform Capitalization Rules & Changes in Accounting Method 6305 Tax Preparation 2023-2024

As the tax season for 2023-2024 approaches, it's time to gear up, grab a cup of coffee, and dive into ...

Read More

Read More

Combination Accounting Method 6300 Tax Preparation 2023-2024

As the tax season approaches, small business owners often find themselves delving into the intricate world of income tax preparation ...

Read More

Read More

Accounting Methods Overview 6240 Tax Preparation 2023-2024

As we gear up for the upcoming tax season, it’s time to delve into the intricacies of accounting methods that ...

Read More

Read More

Accounting Periods 6220 Tax Preparation 2023-2024

As the tax season looms closer, it's time to brace ourselves, armed with information and perhaps a comforting cup of ...

Read More

Read More

Excise Taxes 6180 Tax Preparation 2023-2024

As we delve into the intricacies of income tax preparation for the years 2023 and 2024, it's essential to equip ...

Read More

Read More

Alimony & IRA Deduction Example 4107 Tax Preparation 2023-2024

Welcome to a deep dive into income tax preparation for 2023-2024. Grab your coffee and get ready as we explore ...

Read More

Read More

Are You Self-Employed 6040 Tax Preparation 2023-2024

If you're self-employed, brace yourself, grab some coffee, and let's dive into income tax preparation. Much of the essential information ...

Read More

Read More

Itemized Deduction Overview Software 5012 Tax Preparation 2023-2024

Ah, tax season—a time to flex those math muscles and contemplate life's choices over a cup of coffee. As we ...

Read More

Read More

Health Savings Account (HSA) Deduction Example 4142

Get ready and grab some coffee as we dive into income tax preparation for 2023-2024. In this example, we'll use ...

Read More

Read More

Employment Taxes Example 6162 Tax Preparation 2023-2024

Welcome to our guide on maximizing your income tax refund for the years 2023-2024! Grab your favorite cup of coffee ...

Read More

Read More

Business Owned and Operated by Spouses 6060 Tax Preparation 2023-2024

Grab your coffee and get ready because when it comes to life, there are two certainties: death and taxes. And ...

Read More

Read More

Itemized Deductions Charity Gifts by Cash or Check & Other Than by Cash or Check 5142 Tax Prep

Preparing your income tax returns can feel like navigating a maze, especially when it comes to itemized deductions like charitable ...

Read More

Read More

Medical and Dental Expenses Software Example 5042 Tax Preparation 2023-2024

Get ready with your coffee because we're diving deep into income tax preparation, specifically focusing on medical and dental expenses ...

Read More

Read More

Itemized Deductions – Other Itemized Deductions 5240 Tax Preparation 2023-2024

In the labyrinth of income tax preparation, itemized deductions can be a beacon of hope for taxpayers seeking to maximize ...

Read More

Read More

Itemized Deductions – State and Local General Sales Taxes 5045

This comprehensive explanation of income tax deductions for itemized deductions and state and local general sales taxes provides a thorough ...

Read More

Read More

Itemized Deductions – Gifts to Charity Overview 5140 Tax Preparation 2023-2024

Are you ready to dive into the intricacies of income tax preparation for the year 2023? Grab your favorite mug ...

Read More

Read More

Itemized Deductions – Interest You Paid 5070 Tax Preparation 2023-2024

Are you ready to tackle your income taxes for 2023-2024? Grab a cup of coffee and let's delve into the ...

Read More

Read More

Itemized Deductions – State and Local Real Estate Taxes 5047 Tax Preparation 2023-2024

Income Tax Formula: Income tax preparation involves understanding deductions, which play a crucial role in arriving at taxable income. "Below ...

Read More

Read More

Health Savings Account (HSA) Deduction 4140 Tax Preparation 2023-2024

So, let's summarize what we've covered about Health Savings Account (HSA) deductions for income tax preparation in 2023-2024 ...

Read More

Read More

Capital Gain or (Loss) 3360 Tax Preparation 2023-2024

Welcome, fellow taxpayers, to the intricate world of income tax preparation for the year 2023-2024. As we delve into the ...

Read More

Read More

Alimony & IRA Deduction 4100 Tax Preparation 2023-2024

Alright, let's break down the complexities of income tax preparation for the tax years 2023 and 2024, focusing on alimony ...

Read More

Read More

Self-Employed Health Insurance Deduction 4070 Tax Preparation 2023-2024

In summary, the self employed health insurance deduction allows eligible individuals to deduct health insurance premiums paid for themselves, their ...

Read More

Read More

HSA, Moving Expenses, Deductible Part of Self-Employment Tax, & Self-Employed SEP, SIMPLE 4050

Navigating the complexities of income tax preparation can be daunting, but with a cup of coffee in hand and a ...

Read More

Read More

Other Adjustments to Income 4150 Tax Preparation 2023-2024

Are you ready for the annual dance with the taxman? Grab your coffee and let's delve into the world of ...

Read More

Read More

Business Income or Loss & Other Gains or (Losses) 3320 Tax Preparation 2023-2024

As the tax season approaches, it's time to prepare ourselves with a cup of coffee and a deep dive into ...

Read More

Read More

Student Loan Interest Deduction 4120 Tax Preparation 2023-2024

Welcome, tax enthusiasts! Today, we're delving into the intricate world of income tax preparation for the years 2023 and 2024 ...

Read More

Read More

Certain Business Expenses of Reservists, Performing Artists, Fee-Basis Government 4030

Get ready and grab some coffee because we're about to delve into some handy hacks for income tax preparation, specifically ...

Read More

Read More

Educator Expenses 4010 Tax Preparation 2023-2024

Welcome to our guide on income tax preparation for the years 2023 and 2024. Today, we'll be delving into the ...

Read More

Read More

W-2 Income Example 3100 Tax Preparation 2023-2024

Welcome back to our journey through income tax preparation for the years 2023 and 2024. As we dive into the ...

Read More

Read More

Unemployment Compensation 3340 Tax Preparation 2023-2024

The instructions are fairly clear on how to report unemployment compensation on your tax return. However, understanding the implications and ...

Read More

Read More

Pensions & Annuities 3240 Tax Preparation 2023-2024

Are you ready to take control of your income tax preparation for 2023-2024? If you've got pensions and annuities in ...

Read More

Read More

Alimony Received 3300 Tax Preparation 2023-2024

Welcome to our comprehensive guide on handling alimony and income tax from 2020 to 2023. In this blog post, we'll ...

Read More

Read More

Taxable Refunds, Credits, or Offsets of State and Local Income Taxes 3280 Tax Preparation 2023-2024

As we dive into income tax preparation for the years 2023 and 2024, understanding the nuances of tax refunds, credits, ...

Read More

Read More

IRA Distributions 3200 Tax Preparation 2023-2024

Are you ready to delve into the intricacies of income tax preparation for 2023-2024? Grab a cup of coffee and ...

Read More

Read More

Tax Software Options 1030 Tax Preparation 2023-2024

Get ready and grab some coffee because we're diving into the world of income tax preparation. Today, we'll explore various ...

Read More

Read More

Income Reporting Forms, Concepts, & Overview 3005 Tax Preparation 2023-2024

As we dive into the intricacies of income tax preparation for the years 2023-2024, it's time to grab a cup ...

Read More

Read More

Social Security Benefits 3260 Tax Preparation 2023-2024

Welcome back, readers! It's that time of year again – income tax season. Whether you're a seasoned taxpayer or new ...

Read More

Read More

Who Qualifies as Your Dependent 2060 Tax Preparation 2023-2024

Welcome to the world of Income Tax 2023-2024! Grab your coffee as we delve into the intricacies of tax preparation, ...

Read More

Read More

Affordable Care Act – What you Need to Know 1130 Tax Preparation 2023-2024

Grab your coffee and get ready to dive into the intricacies of income tax preparation for the year 2023-2024, with ...

Read More

Read More

Standard Deduction 2050 Tax Preparation 2023-2024

As we gear up for another tax season, it's time to delve into the intricacies of the Income Tax 2023-2024 ...

Read More

Read More

Income Tax Formula 1090 Tax Preparation 2023-2024

Get ready and grab some coffee, as we delve into the intricacies of income tax preparation for the year 2023-2024 ...

Read More

Read More

Name & Address 2030 Tax Preparation 2023-2024

Welcome to our guide on Income Tax for the year 2023-2024! Before you dive into the nitty-gritty of tax preparation, ...

Read More

Read More

Do You Have To File 1145 Tax Preparation 2023-2024

Filing taxes involves understanding both legal obligations and potential benefits. The information can be found in Form 1040 Tax Year ...

Read More

Read More

Social Security Number (SSN) 2040 Tax Preparation 2023-2024

Preparing for income tax season in 2023-2024 requires more than just grabbing a cup of coffee. One crucial aspect is ...

Read More

Read More

Tax Law & Tax Authority 1110 Tax Preparation 2023-2024

A general overview of the hierarchy of authority in income tax preparation for the tax years 2023 and 2024. Understanding ...

Read More

Read More

Marginal & Average Tax Rates 1070 Tax Preparation 2023-2024

Grab your coffee and get ready to dive into the intricacies of income tax preparation for 2023-2024. In this blog, ...

Read More

Read More

Budgeted Balance Sheet Data Input 11200 QuickBooks Online 2024

In summary, as of the current version of QuickBooks Online in 2024, it seems that the software does not have ...

Read More

Read More

Budgeted Income Statement Correction 11143 QuickBooks Online 2024

Grab your coffee, and let's dive into QuickBooks Online 2024 for a budgeted income statement correction. In our journey with ...

Read More

Read More

Methods & Tools for Learning Tax Law 1020 Income Tax Preparation 2023-2024

Preparing your income tax returns for 2023-2024 may seem like a daunting task, given the complexity and constant changes in ...

Read More

Read More

Why & How To Learn Tax Law 1010 Tax Preparation 2023-2024

Grab your coffee, because we're about to embark on a journey to master income tax preparation for 2023-2024. The burning ...

Read More

Read More

Navigation Overview & Company Settings 6060 QuickBooks Online 2024

Navigating QuickBooks Online 2024 can be a breeze once you understand the key features and settings. In this overview, we'll ...

Read More

Read More

Inventory Tracking Options 6280 QuickBooks Online 2024

Welcome back to our QuickBooks Online journey for 2024! In this leg of our adventure, we're strapping on our hiking ...

Read More

Read More

Deposits to Checking Account From Payment to Deposit Undeposited Funds 7160 QuickBooks Online 2024

Welcome to our journey through the world of QuickBooks Online 2024! In this blog post, we'll be exploring the efficient ...

Read More

Read More

Purchase Order Adding New Items 8080 QuickBooks Online 2024

Welcome back to QuickBooks Online 2024! In this session, we're diving into the nitty-gritty of entering purchase orders (POs) and ...

Read More

Read More

Manage Users 6120 QuickBooks Online 2024

In conclusion, managing users in QuickBooks Online 2024 is crucial for maintaining control and security over your financial data. QuickBooks ...

Read More

Read More

Accounts Payable Aging Reports 4060 QuickBooks Online 2024

Understanding and effectively managing accounts payable is crucial for maintaining financial health and accuracy in your business records. QuickBooks Online ...

Read More

Read More

Adjust Opening Balances 6400 QuickBooks Online 2024

In the dynamic world of QuickBooks Online 2024, efficiently adjusting opening balances is a crucial step in seamlessly transitioning to ...

Read More

Read More