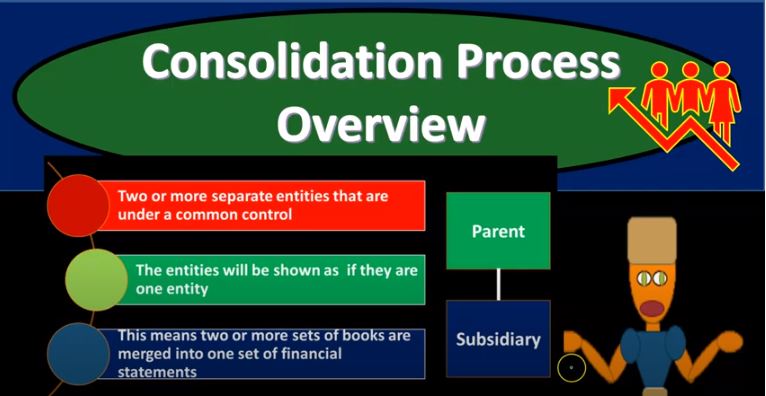

In this presentation, we will take a look at an overview of the consolidation process, get ready to account with advanced financial accounting, consolidation process overview we’re talking about a situation where we have two or more separate entities that are under a common control. So the basic kind of format of that you’re imagining here, then you have a parent and a subsidiary, these are going to be connected in some way shape or form because the parent has control over the subsidiary, we can imagine more complex situations, for example, having one parent and multiple subsidiaries as well. The entities will be showing as if they are one entity. So if we have a situation like this, if there’s a control type of situation, it’s quite possible then we’re going to have the the subsidiary and the parent These are two separate companies have a consolidated basically a financial statement. So the financial statement the idea of that being we’re going to take these two financials and represent them as if these two separate entities in this case, two or more can be more than two are one entity. This means two or more sets of books are merged into one set of financial statements. So obviously, what does that look like from a practical standpoint, we have the parent company, we have this subsidiary company, they have two sets of books, we’re gonna have to take those two sets of books and put them together for the financial statements. Here is an example of a slightly more complex situation where we still have parent subsidiary relationships but multiple pole subsidiaries in this case, so we have the parent subsidiary one where there’s a 75% ownership. So we’re over we have a controlling interest, we’re over that 51, we’re going to say there’s a controlling interest here, therefore there’s going to be a consolidation. So we’re gonna have a consolidation subsidiary to is owned 52%. So we’re still over the 51.

01:46

We’re going to say it’s a controlling interest here. Therefore, we’re going to be consolidating. In this case, this one these this financial statements for this company, this one for this company, and then the parents company, and then this one over here. There’s this significant investment. But it’s not a controlling interest, but it is over 20. So it’s over 20%. But it’s not controlling, it’s not over 51. So there might be significant influence there. But we’re not at the state of the point of controlling interest. And therefore, it’s likely that this one will be accounting for using the equity method. So under this type of situation, we’ve got a parent company, we’ve got subsidiary one and subsidiary two, which basically we would consolidate where they can consolidate the financial statements. So we have three separate companies that we’re going to consolidate as if they were one entity. And note again, this isn’t 100% ownership up here, and we’re still going to basically consolidate them together as basically one entity due to the fact that the parent has controlling interest, right, they can basically control what’s going to happen through through the controlling interest of ownership over here, however, not a controlling interest, but significant influence therefore, equity method is being used. So not, we’re not going to be consolidating the financial statements for this company, but we will be recording it with regards to the equity method. So eliminating entries, eliminated entries may be needed to consolidate financial statements. So in other words, when we merge these financial statements together, then we could we can imagine what we’re going to do, we got three line items, you can just we’re going to merge them together. And then there’s going to be some entries that we’re going to have to basically eliminate during that consolidation process as well, for example, and eliminating entry may be needed. that removes the investment accounts for the parents balance sheet and the subsidiaries equity account. Because you because those things are going to be basically related. And we’ll take a look at an example of this. I think this becomes more clear, of course, when we do some practice problems that we’ll work through some practice problems, to see those eliminating entries in a future presentation.