Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the remeasurement process for financial statements of a foreign subsidiary. Get ready to account with advanced financial accounting remeasurement financial statement of foreign subsidiary remeasurement overview so we’re going to go through the process of the remeasurement. As you think of the measurement process, you want to be comparing and contrasting it to the translation process. So you’re envisioning basically you got a parent company. The parent company has a subsidiary the subsidiary is a foreign subsidiary. The subsidiary then conducts their books. Typically we’re thinking in a foreign currency right, that subsidiary is conducting their books in a foreign currency. If we need to consolidate the subsidiary into the parents financial statements, the parent uses dollars to measure their books subsidiary uses a foreign currency on the bookkeeping side, how do we get them over $2 so we can do the consolidation process. two methods generally we can use a translation method or a remeasurement method, and we have to determine which method we’re going to use by determining what the functional currency is. And once we know what the functional currency is, then we can determine whether we need to use the translation method or the remeasurement method. And they’re going to be slightly different. Now note, there’s also a third kind of option where we might have to use translation and remeasurement if there was a situation where the foreign currency has the financial statements, and something other than the US dollars and then the functional currency was not the currency that their bookkeeping was in, and it’s not the US dollar.

01:34

And and so then we would have to do both remeasurement and translation. But the typical case is that the foreign currency the foreign subsidiary has their books in the foreign currency, and we have to determine if that foreign currency is the functional currency or if the US dollar is the functional currency and that’ll help us determine whether or not we use a remeasurement process or we use a translation process. The functional currency for the foreign subsidiary is the foreign currency that they’re keeping their books, then we use the translation process. If the functional currency is actually the US dollar, even though they’re conducting their books in the foreign currency, then we use the remeasurement. So remeasurement is going to be similar to the translation process, the goal is to get the equivalent US dollar values for the foreign affiliates accounts so that we can combine or consolidate them with the US company’s financial statements. So that’s our end goal. Again, you’re imagining here, where the parent company would imagine ourselves as the parent company, we have a subsidiary in a foreign country, they conduct their books in a foreign currency. Our goal is to get the foreign currency to be transferred to be in US dollar equivalent somehow, so that we can then do the combination if necessary, for the parent and subsidiary relationship. We use different exchange rates for those use for translation. So this is going to be a difference that we will have Have when we have translation, we’re going to use some some different rates some of the time, as we go through the translation process, this will come become much more apparent when we work through practice problems highly recommend working through practice problems. But if you’re imagining basically all the bounce in accounts and all the income statement accounts, you would think that we would just be able to use one exchange rate, so that we start with something in balance, and we’ll end with something in bounced.

03:23

But that is not typically the case. And you could you could think about why we would use basically different exchange rates, we’ll get into that more when we work through the problems, but we’re going to use different exchange rates at a minimum because the balance sheets gonna be basically you would think the ending date would be good for the balance sheet because it’s as of a specific point in time, which would be the ending date of the balance sheet date, where the income statement has a range, so you think some kind of average would be good for it. And if we use different rates, then we’re going to end up with something that’s not in balance. So we’re gonna have different rates that will be used and there’ll be different between as well the translation process and The remeasurement process, the result is a different dollar values for the foreign affiliates accounts. So we’re gonna have different you know, the different dollar amounts will result as we convert from the foreign currency to the US dollar equivalent because we may be using different rates between the two methods. So remit remeasurement process, the balance sheet is divided into monetary and non monetary accounts. So we’re going to think about the balance sheet, we’re going to be breaking the balance sheet out into these two categories monetary and non monetary accounts. Monetary is related to money, of course, include the amounts fixed in terms of the units of currency, so they represent amounts that will be received or paid in a fixed number of monetary units. So things that you’re going to be receiving or pain in monetary units that of course includes cash, and it’ll also include the receivables because if you think about the receivables, you’re thinking, we’re going to get paid basically in cash, we’re going to be paid in something that’s in the monetary units. Therefore, it makes makes sense for us to use what I would think of basically as the default balance sheet rate. So when you’re thinking about the balance sheet, in other words, you’re thinking about something as of a point in time. So if you have the financial statements created for the year ended December 31, the balance sheet will be as of December 31. So if you were to pick a rate, you would think the default rate then would be the exchange rate as of December 31. That’s what I would think of as basically the default rate for the balance sheet for translation.

03:24

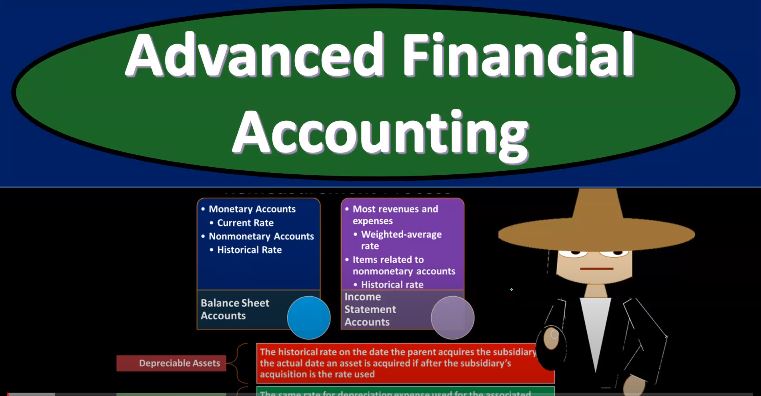

That’s the rate we use most of the time rather than what we’re doing here. remeasurement for assets and liabilities and translation, we typically use the end date of the balance sheet date. For translation, we’re for the remeasurement however, we’re going to deviate from that more and so we’re not going to deviate are where we have this monitor the monetary items, so the monetary items being cash, and then the receivable would make sense because we’re going to get paid in monetary units. So we’re going to remeasure that not when we got the receivable When people owed us the money, but when, at the end of the day just like we would before, because we’re going to be receiving cash, it’s the monetary unit. Same with the payables, same logic behind that. So we’ll be using what I would think of as kind of the default rate there on these accounts, then we’re going to be used the same rate for the balance sheet account than we typically would for the translation process. So remeasurement process balance sheet accounts. So we have the monetary accounts are going to be using the current rate and then the non monetary accounts. So things that are non monetary, like the inventory possibly, or property, plant and equipment, land and whatnot, those are going to be using historical rate. So we looked at the monetary accounts, these are the ones that will differ the non monetary accounts, I mean, will be the ones that will differ typically from the translation process and the remeasurement process. So for the remeasurement process, we’re actually going to have to go back and basically look at when these things were purchased like that, like the property plant and equipment, we’ll have to consider The historical rates to use and think about when they’re purchased, or when, when the parent company purchased a subsidiary. And then on the income statement accounts, most revenue and expense accounts will use the weighted average rate. So on the income statement accounts, it’s going to be very similar to the translation process in that most of the accounts will use the weighted average rate, which makes sense that would be what I would think of as the default account for the income statement, because the income statement is covering a time frame a beginning and an end. And therefore, if we’re going to choose one rate to represent the amounts on the income statement, you would think we would use some type of average some type of representative right that will represent the entire time period. However, there is a difference for the remeasurement in that the items related to non monetary accounts will use the historical rate. So items with a non monetary account, so things like depreciation, which are linked to the assets, we’ll be using it we’ll be using a historical rate, which is something that will differ on the remainder remeasurement process which we’re looking at here and the translation process, so depreciable assets, the historical rate on the date, the parent acquires the subsidiary or the actual date and asset is acquired if after the subsidiaries acquisition is the right to use. So this is where it gets a little bit confused in here, because we’re talking about a balance sheet account here. We’re saying Okay, now we have the historical rate, we’re going to deviate from what we typically do for the translation process. And then we’re going to think about, well, what rate would we use, then we’re going to be using the rate either that the depreciable asset was was purchased. So we’ll use the historical rate. However, if the if the asset that was purchased for the subsidiary was purchased before the time in which the parent company purchased the subsidiary, then we’re going to use the time period that the parent purchased the subsidiary. So it’s going to be the later of the rate that we’re going to use will be the later of the time that the parent purchased the subsidiary and the way I would think about that Is that when the parent purchased the subsidiary, that was basically kind of like a market transaction.

09:05

So that that’s when the cutoff we would be would go back to that would be like the historical rate because that was kind of like a market transaction. That’s how I would kind of think of it. And so if it was purchased before the parent company purchased that subsidiary, you use that rate. And then if it was purchased, after the parent company purchased the subsidiary, then you’re going to use the rate the historical rate of when it was purchased. And then we have the depreciation is going to be the same rate for depreciation expense used for the associated acid. Again, this is going to be something that’s going to be different, but not too difficult for us. Once we know what the rate is for the assets, then we can use the applicable rate, same rate for the depreciation notice it can get somewhat complex However, because we’re going to be breaking this down to individual purchases of equipment that could have different historical rates. So we might not be able to apply one rate to the line item. Have either depreciable assets or depreciation, we might have to have another schedule to kind of break this thing out as time goes by. And as more depreciable assets get purchased, obviously, you know, not hopefully not too many depreciable assets get purchased each year because, you know, they’re large items, and therefore, there’s not going to be activity all the time in them. But you can imagine it getting more and more complex, you know, as time passes. So the remeasurement process, then we have the cost of goods sold. So when we think about the cost of goods sold, then we’re going to break this down into its components to cost of goods sold calculation, and then think about the rates that will be related to it. Again, this will differ from the translation process. If it was translation, rather than remeasurement that we’re using here. We could just use basically the average rate easy, you know, apply that to the cost of goods sold line item we’re done, but with the cost of goods sold in the remeasurement process, we got to break it down because now we got the inventory which is non monetary on the balance sheet, and the Related account on the income statement is the cost of goods sold expense account. But it’s going to be somewhat complicated because we got to break down, you know, the components of the cost of goods sold. So we’re going to say, all right, the beginning inventory, we have to use the historical rate on the date purchased, then the purchases, we’re going to use the average rate for the purchases, this is our cost of goods sold calculation, that gives us the cost of goods available for sale, which now has basically a mixed rate. And then that’s, then we’re going to subtract out the Indian inventory. The Indian inventory is related to the asset, you know, account. So that’s going to be using the historical rate on the date purchased, we’re going to because it’s a non monitor, and then that’s going to give us the cost of goods sold, which is basically then of course, a mixed rate that we have. So it’s a bit more complicated, kind of a lot more complicated to calculate the cost of goods sold with the remeasurement process then for the translation process. Then we have the retained earnings. So we have been calculation of retained earnings. Now, when you think about retained earnings, of course, if it’s a, if it’s a trial balance that they give you, then you got to think well, are they giving us? Am I looking at retained earnings before the income statement is closed out into it? Or am I looking at, you know, retained earnings after everything is closed out into it. In other words, similar process that we’re going to need happen here, we’re gonna have to break the retained earnings into the components for the calculation of it. And then think about how we’re going to apply the rates. This is similar to the translation process, there’ll be a little bit of a change, which will be here the process is similar to the translation, because the reason is because obviously part of the calculation for the retained earnings includes the net income and the dividends. And for the net income, we’re going to have to we’re gonna have to use basically the rates that we used on the income statement because we’re talking temporary accounts. And for the dividends, we’re going to use the historical rate, whether we use the translation or remeasurement method. However, on the income statement, the rate that we’re going to be using here will have the average rate is what we usually use on the income statement accounts for the translation method. But here like we said, those those things that are related to balance sheet accounts that are non cash items like like the depreciable assets, we use the historical rates.

13:23

So now we’re gonna have to do that for the net income when we think about the retained earnings because we’re obviously the net income rolls into the retained earnings. And now the net income is being translated using multiple different rates. So we’ll have to pick up that whatever the retained earnings is after we use both the average and historical rates applied to the proper accounts. So the process is similar to translation. The difference is that while most income accounts are measured using the weighted average rate items related to non monetary balance sheet items are re measured using the corresponding historical rates. depreciation expense is going to be an example of that. So the rest of it is going to Similar to the translation process, so we’ll have the retained earnings beginning balance, which will have a mixed rate, which is basically going to be last year’s number and it will be the beginning balance, then we’ll have the net income, which is going to be at the average and historic rates.

14:14

This is where differs a little bit because if this was just the translation process, if we use one rate for the entire income statement, the average rate, then we can actually take net income and just multiply it times that line item. However, since we’re going to be using two different rates on the income statement for the remeasurement, average and historic, then we got to basically break that out and figure out what net income is, and we have those two rates, so it’s a little bit more complicated, then we’re going to subtract the dividends, same process in net, we’re going to be using historical rates, the rates when the actual dividends were paid. And that’s simple. That’s going to be the same for translation and remeasurement. That’s going to give us then the retained earnings at the end, which will be mixed. So remeasurement processed, the end result of the remeasurement process is the same as it If the foreign entities transactions have been recorded in dollars, so that’s, that’s kind of the objective, we want to basically be happening here. So when you think about remeasurement, and and you can think about the reasoning of this, you’re saying, Okay, if you’re saying that the foreign you got the subsidiary in the foreign company, they got their books in foreign currency. And then the question is, is the functional currency, the foreign currency? If it was the foreign currency, if their functional currency is the foreign currency, then we’re, the idea was like, well, it’s proper, then that they keep their books in the foreign currency because that makes sense, because that’s their functional currency will just take those numbers and translate them into US dollars, so that we can then do measure them in one measure in unit and combine them together with the parent. However, if the functional currency is actually the US dollar, because even though the books are in the foreign currency, and the foreign company is in, you know, a foreign country, it’s actually more linked to the parent company in some ways. You can go over the characteristics in a prior presentations about what it means to be a functional currency. But if that were the case, if the functional currency is the US dollar, then the idea is, well, really, we should basically be putting this together as if the transactions were recorded in US dollars. Basically, we translated all the transactions in US dollars. So that’s kind of where the differences are coming into play with the remeasurement. And the translation, even though we’re we’re looking to get to really kind of the end goal, and that we have something that’s really measured in dollars.

16:31

So we can do our combination item but the difference is going to be on focus on what what the functional currency was between the two. So the debits and credits will remain equal in the local currency trial balance. So obviously, we’ll start with the trial balance for the local currency, it will be in balance in terms of the local currency, and then due to use of different rates during the repayment process. The debits and credits will generally not be equal after we measure the trial balance. So then we’re going to remeasure the trial balance from the foreign currency to US dollars, we’re going to use different rates to do that, as we have discussed, since we’re using different rates and not one rate, we will then be out of balance in terms of debits and credits, it remeasurement gain or loss will be used to balance the trial balance, we’re then going to record a remeasurement gain or loss because we’ll be out of balance and the difference is going to go to the remeasurement Bank gain or loss. Now the remeasurement gain or loss will be included in the income statement, not other comprehensive income. This is what’s different here. Another thing that’s kind of different from the translation process and translation, we would put the difference into other comprehensive income. We’re basically saying by putting it into other comprehensive we’re basically saying, you know, we did our best to use the best rates and we have this difference due to the different rates we’re going to use and we’re going to put it into other comprehensive income so that you can see net income without you know this included in it and then you can see the effects of the remeasurement process for translation with revisions. With with the with the remeasurement process as opposed to translation, we’re actually gonna put it on the income statement, it’ll be included in net income.

18:09

And the thought process there is that, you know, if these items were conducted in, if the transactions were actually translated into dollars as the transactions happened, then we would have these gains and losses as a result of those transactions because we would be we would be recording the books in dollars, which would be the thought process of, of what we’re trying to represent here considering the fact that the functional currency is actually dollars. And so that means it would be appropriate then to have the gains and losses on the income statement. So remeasurement process the remeasurement gain or loss will be part of the income statement, because if the transaction had originally been recorded in US dollars, the exchange gains and losses would have been recorded this period as part of the adjustment required for valuation of foreign transactions. So that’s remember your mindset for revision Is that all they did their books in the foreign currency but, you know, the functional currency is the US dollar and therefore, we should record their books as if they were recording them in the US dollar which would have resulted in gains or losses due to the translations when you know, they were conducting transactions in foreign currencies that they were then going to measure in, you know, the US dollar. Once the remeasurement process is complete, the foreign entities financial statements will be presented as they would have been if the US dollar had been used to record the transactions in the local currency as they occurred. So once again, that’s kind of like the objective. Let’s go through that one more time. Once the revision process is completed, the foreign entities financial statements will be presented as if they would have been if the US dollar had been used to record the transactions in the local currency as they occurred.