Advanced financial accounting. In this presentation we’re going to discuss intercompany transactions. So typically we have a situation where where we have a parent subsidiary relationship or thinking about a consolidation type of process within it. And then we have those intercompany transactions between the companies that need to be consolidated between parent and subsidiary, get ready to account with advanced financial accounting intercompany transactions, the intercompany transactions we’ll be focusing in on here and working some practice problems in on will include the intercompany receivables and payables need to be eliminated for consolidated financial statements.

Posts with the consolidation tag

Consolidation With Difference Simple Example

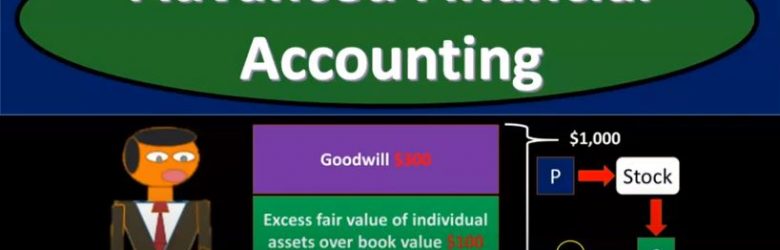

Advanced financial accounting. In this presentation we’re going to talk about the consolidation process with a differential we’re going to look at the component parts with a simple example a simple calculation, you’re ready to account with advanced financial accounting, consolidation with differential example. So here’s going to be the basic scenario for many of the practice problems we will be looking with. We have P and S, there’s going to be a parent subsidiary relationship in which we will be making consolidated financial statements. How did this situation take place what constituted this situation, we’re going to say that in this example, P is purchasing the stocks of S. So notice they’re purchasing the stocks of s and therefore negotiating the stock price, which we’re going to say is $1,000 here. Now to simplify this example, you first want to think about this as p purchasing 100% of the stock of s for $1,000. And then once they have control, anything over 51% would then be controlled.

Consolidation When There is a Book & Fair Value Difference

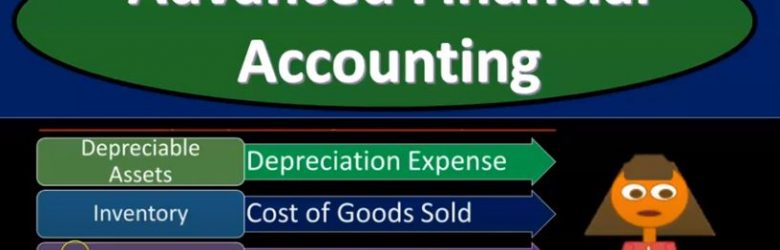

Advanced financial accounting. In this presentation we’re going to take a look at a consolidation process when there is a book and fair value difference. In other words, we’ll have a consolidation. We have two companies, we have a parent subsidiary type of relationship, and the parent has a controlling interest of the subsidiary. Therefore consolidation is what we’re going to be doing. That means we’re going to take two separate sets of books combine them together as if they were one. And we had some complications with the fact that when the purchase took place, there was a difference between the book value and the fair value, what will be the effect of that difference on the consolidation process, elimination entry example. So when we consider this difference, we want to think about what’s going on with the parents books and the subsidiaries books and then what would be the process to consolidate them and what type of problems would be caused if there was a difference between the book and fair value of the net assets so the parents books investment accounts starts out containing the acquisition costs at the fair market value of net assets and goodwill, so we have, that’s basically what’s going to be on the parents books, right. And we’re thinking here typically have an equity method being used. So we have the parents books, we have the subsidiary books that we’re gonna have to consolidate together, and then do our elimination entries. And on the parents books, you’re accounting for the subsidiaries.

Consolidation Calculations Less Then Wholly Owned Subsidiary

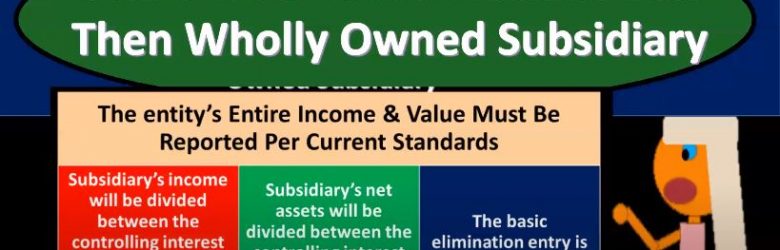

Advanced financial accounting. In this presentation we’re going to talk about consolidation calculations for less than wholly owned subsidiaries. So we have a parent subsidiary relationship, we’re going to be looking at the consolidation process to put the financial statements of the parents and the subsidiaries as if they are one entity, but we don’t have a wholly owned subsidiary. In other words, the parent does not own 100% of the subsidiary. How do we do the consolidation? in bad case, consolidation calculations less than wholly owned subsidiaries, that entities entire income and value must be reported per the current standards? So in other words, once again, we might think, well, on the income statement, maybe we would just report the part of the subsidiary that belongs to or is controlled by the parent, but that’s not typically the case. That’s not the case under generally accepted accounting principles.

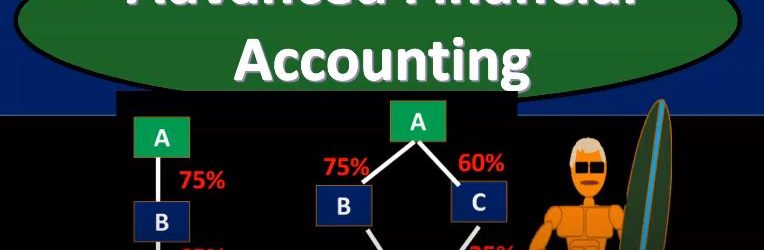

Direct & Indirect Control

Advanced financial accounting. In this presentation we’re going to talk about the concepts of direct and indirect control. If you’re ready to account with advanced financial accounting, we want to consider these concepts within the context of financial statements and consolidation. So you’ll recall that when we have consolidated financial statements, the idea is to put two financial statements together when one company has basically control over another company that being defined typically by having more than 51% interest because if you have more than 51%, then you have basically a voting share for you to vote on anything, then of course, you would win the vote at that point in time. So let’s consider then direct control and indirect control direct control when one company has a majority of another company’s stock common stock. So that would be a situation where you got a and b, one company has a majority interest over 51% control is pretty easy to see at that point. When you start to get into indirect control. This can get more complicated things can get more confusing here. So indirect control, one company’s common stock is owned by one or more other companies that are under common control. So this can get a lot more detailed structure in terms of what is going to constitute control. So for example, if we have direct control, then you have just simply a parent subsidiary type of relationship. And, you know, the parent has more than 51% of the subsidiary, interest common stock. So and that could happen if we have to, we could still have a little bit more complexity here, where we have two subsidiaries, right. But they’re both going to be consolidated in this case, because there’s 75% over 51% direct control is parent over as one direct control over as to here because it’s over the 51%. So both of these cases would be direct control.

Consolidation for Non Wholly Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to talk about a consolidation for a non wholly owned subsidiary. So in other words, we have a parent subsidiary relationship, but the parent doesn’t own 100% of the outstanding common stock of the subsidiary but something other than 100%. In other words, over 51% controlling interest less than 100% get ready to account with advanced financial accounting. Non controlling interest often will be represented NCI non controlling interest. So notice if we have a parent subsidiary relationship we’re talking about there is some controlling interest, the controlling interest is the interest that’s going to be over 51%. However, if we don’t have 100% ownership, then we have the amount that’s not in control and that of course is going to be the non controlling interest. So non controlling interest. NCI controlling interest is needed for consolidation. Obviously, if we’re going to consolidate this thing, that means typically that A parent has some controlling interest over 51% a 100% is not needed. So 100% of ownership, in other words, by one parent to the other is not necessary for a consolidation to take place control is necessary, which is typically over 51% less than 100% ownership will result in a non controlling shareholder, those other than the parent.

Usefulness of Consolidated Financial Statements

Advanced financial accounting. In this presentation we’re going to take a look at the usefulness of consolidated financial statements. In other words, consolidated financial statements taking two or more companies where there’s a parent subsidiary relationship, putting them together representing financial statements as if those entities were one entity. What are the pros and cons of using consolidated financial statements? Get ready to account with advanced financial accounting idea of consolidated financial statements? In other words, why did we come up with the consolidated financial statements? So remember, we’re talking about a situation where there’s a parent subsidiary relationship, there’s a controlling interest, we have one company that has a controlling interest in over 51 interest in the other company. And then we’ve come up with this concept of showing the Consolidated Financial Statements showing the entity the parent and the subsidiary entities of which there’s a controlling interest as if they were one entity. Why do that? So when company creates or gets controlled Another company, that’s going to be the scenario we have. So we have a parent subsidiary relationship due to that fact due to one company having control than another company. You can think of that, of course in a stock situation owning for more than 51%. The result is a parent subsidiary relationship. So if we just have the two entities, it would look something like this.

Consolidation Process 100% Owned Subsidiary

This presentation we’re going to take a look at the consolidation process for a 100% owned subsidiary. In other words, when we’re thinking about one company owning another company in advanced financial accounting, we’re usually looking at the situation and spending most of our time where we have some kind of consolidation process. So we want to Vin take the consolidation process and look at it in levels of complexity. So we’re going to start with a level of complexity, that’s going to be an easier setting where we will have 100% owned subsidiary, and then we’ll go from there and add more complications to it. Get ready to account with advanced financial accounting to ownership and control and prior presentations, we took a look at different methods based on different levels of ownership and control. We said in general, if we had zero to 20%, we use the carried value and then 20 percents kind of an arbitrary number, but if we’re over that amount, we’re really looking at the term of significant influence it for over the 20% from 20 to 50% then The assumption is that we would be using the equity method because the assumption would be if over 20% unless spoken otherwise, unless some unreal, some reason, otherwise, we would then have this significant influence and therefore be justified to use the equity method. And then if you’re over 51%, then you may have the consolidation. Now, when we think about these two methods that they carried value in the equity method, we can basically explain those as we go, you know, if you got anything from zero to 20%, then we could just basically say, yeah, then you fall into this category, let’s talk about the accounting in general.

Consolidation & Income Taxes

Advanced financial accounting PowerPoint presentation. In this presentation we’ll talk about consolidation and income taxes get ready to account with advanced financial accounting. For a non taxable acquisition, the tax basis of assets acquired and liabilities assumed is not changed from the acquisition. In this case, then the carrying basis is the acquire ease basis, the acquiring company needs to identify all assets and liabilities acquired and their fair market value when the acquisition takes place, and then the deferred tax assets or liabilities that are from the difference between the fair market value and the tax basis when allocating the purchase price must be recorded by the acquiring company. So we have the tax expense allocation. When consolidated return is filed. What are we going to do with this tax expense allocation, the parent company and subsidiaries can file a consolidated income tax return or they can choose to file separate returns. So this is one of the things that we kind of have to consider here we’ve got a controlling interest that’s going to be involved. So we have two entities, one has a controlling interest and the other obviously parents subsidiary type of relationship question, then should we report just one tax return? Or should we have two tax returns, this is going to be a decision that needs to be made. But if we file one tax return, then at least 80% of its stock must be held by the parent company or another company included in the consolidation return for a subsidiary to be eligible to be included in a consolidated tax return.

Consolidation – Interim Acquisition

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidation and interim acquisition. In other words, we have a parent subsidiary relationship that parent owning a controlling interest over 51%. However, that controlling interest took place for a purchase of the common stock of the subsidiary that happened in the middle of the year. So prior to this, we’ve been talking about situations where we are doing consolidations for an entire year. And you may have question probably popped up in your head at some point in time as well what would happen if the purchase took place in the middle of the year now we have that mid year kind of purchase worse, especially concerned with that first year where the consolidation didn’t really happen. I mean, there wasn’t a consolidated ownership until sometime in the middle of the year, get ready to account with advanced financial accounting. So we’re talking about a situation where we have a consolidation but the consolidation happened in the middle of the years. We’re thinking about that first year, primarily What would happen? Well, if the consolidation didn’t take place in January in other words, the parent didn’t purchase the controlling interest in the subsidiary at the beginning of the year but happened at some point in the middle of the year what’s going to be the impact on the year in consolidation, which typically happens for the entire year? Well, the subsidiary is seen as being part of the consolidated entity from the time the stock is acquired, even if acquired in the middle of the year.