Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

00:48

So if, for example, we have the financial statements for the year ended, December 31, the balance sheet will be as of the point the last date of the time range, December 31. And then we want to know, well, how well will this company do in the future? They’re going to make us money if we if we were to invest in them? Or if you’re a bank, your question is, are they going to be able to pay off the loan if we loan them money, or something like that? For that, we need the timing statement, we would like a timing statement that tells us how their performance will be in the future. But we can’t do that. So we have to look at the past in order to think about how they might do in the future, just like we would with any kind of performance metric. For anybody doing anything like it like someone working at a job, or someone who’s a sports, the sports or something like that. How many hits did they have last time? How many, you know, stats did they have last year compared to what we think they’re going to do next year? That’s going to be the income statement?

01:41

These are the primary two statements that you want to be thinking about them, they’re going to answer the most questions. They’re going to be the balance sheet, where do they stand at a point in time income statement? How did they do to get in, you know, the last season? How did they do last season? You know, how did they do last year? How are they going to predict how much how well they’re going to do next year. But then we need a linking statement, that’s going to be the statement of retained earnings. So that means that we’re going to tie out that’s going to be the statement that’s going to tie out the balance sheet before the period that we’re working on to the balance sheet that we’re working on in this period. So these two statements balance sheet income statement, primary two statements, the statement of retained earnings kind of linking those two statements together and to the prior period. So these are the major components you want to think of with the financial statements when you’re thinking financials just thinking balance sheet income statement, and then you’re thinking retained earnings is going to link balance sheet income statement and link to the prior period to the prior period balance sheet.

02:39

These statements however, are on an accrual basis on an accrual basis is typically thought of to be best for measurement purposes for performance purposes, rather than a cash basis. Because an accrual basis is going to recognize the revenue and the expenses on the income statement, the timing statement here. When revenue, you’re going to recognize revenue when work was actually done. And you’re going to recognize expenses when you actually consumed the expense in order to generate revenue in the same time period. You might ask why don’t you just recognize revenue when cash is received and cash is paid? You could do that. But it’s easy to distort things, when you do that by simply changing the cash flow. So then you can just change when you’re going to receive the revenue or when you’re going to pay or when you’re gonna receive the cash or when you’re going to pay the cash. And that could be an easy way to then distort the financial statements. So we don’t want to distort the financial statements, we want to basically represent, you know, the true earnings and the true expenses on the financial statement, even if we have not yet paid Pac cash, even if the cash is going to be paid or received at some other date.

03:45

But the cash flow statement, the cash flow is really important. We mean cash is going to be like the the blood of the economy. You know, it’s like it’s the thing that makes everything work, right. It’s a it’s the it’s going to lubricate the whole economy here, we need to know what you know the cash flow was okay. So therefore, we want to add to it the statement of cash flows. So the statement of cash flows is then going to be added on to give us those cash flows that we don’t have on the income statement because now we’re doing the income statement on an accrual basis. Therefore, you want to think about these statements up top as being done together. If you were imagining creating the financial statements, you would do these two these first, because these are the statements that are basically the bookkeeping is done in the accrual basis statement, meaning when you enter the information into the financial data, we’re basically putting together and constructing on an accrual basis, typically the balance sheet and the income statement statement of retained earnings.

04:43

And then you’re going to take that information, rearrange it from an accrual basis, basically to a cash basis so that we can then also see the cash flows. Cash Flows will also be a timing statement. It’s going to tell us how we have done over the time period, it’s not as of a point in time. It’s going to Tell us how we have done it ties into the balance sheet, but it’s going to tie in to the cash component of the balance sheet. In other words, the retained earnings, we said kind of tied out of the the income statement, the balance sheet in the prior period, the balancing of the current period, the statement of cash flows is going to is going to tie out the cache from the prior period to the cache in the current period. And it’s going to tell us the flows the activity that has happened during the period. So here’s gonna be our financial statements. We’ve got the balance sheet over here, assets equal liabilities plus equity. We saw in prior presentations, the income statement, and the income statement is the activity statement.

05:39

But it is on an accrual basis, the income statement is on an accrual basis, meaning this revenue up top represents revenue, because we have done work in order to generate or earn the revenue in accordance with an accrual concept called revenue recognition. And all the expenses are on the books because we have actually incurred the expense at the point in time, you know, in order to help us generate revenue in the same time period. So for example, this cost of goods sold up here is an example of an accrual kind of thing. Because the cost of goods sold represents the cost of the inventory that we are consuming at this point in time, we didn’t actually buy the inventory necessarily, in this year, because when we bought the inventory, we put it on the books as an asset on the balance sheet over here. And then when we consumed it within expensed the inventory, reducing the inventory on the balance sheet and recording the expense, so that we recorded the expense not when we paid the cash, but rather when we consumed it in order to help us generate revenue.

06:40

The depreciation is another, you know, primary example we’ll take a look at in the future, which basically is is related to the property, plant and equipment. So for example, if you were to pay cash for a building, and you paid 300,000, for a building cash, it would really distort things if you were to put an expense in the current period related to that purchase. Why? Because that building’s going to last hopefully, for a long period of time into the future. And so if you were to compare this statement to another statement this year to next year, the building a $300,000 expense, would distort that comparison greatly. So what we do instead is we deviate from the cash basis to an accrual basis, we put the building on the books as an asset. And then what we do is we depreciate it, it’s called depreciation. And we record the depreciation which is allocating the cost of the building, whether we bought it for cash or financed it, allocating the cost of the building over the time period in which we consume it to generate revenue.

07:38

So that’s going to be another example. And we’ll see that example when we construct the statement of cash flows as a primary difference. But you can see the income statement then is not on a cash flow basis. So that means that we’re going to, we’re going to want another statement that gives us the cash flow. So you can see why we would do that on the income statement, hopefully, because it helps us to measure on a performance measure basis. But cash flow is also like we say very important, we not we need to know what the cash flow is to. Therefore, we’re going to tack on then to the statements a statement of cash flows. So remember that the statement of cash flows you can think of is kind of separately, if you’re going to construct this thing, you would make the balance sheet in the income statement. And then the statement of retained earnings is tying together the balance sheet in the income statement.

08:24

These three statements are just made, you just construct these, you know, when you’re doing a normal accounting system, these are all normal components of the construction, and they all come from like the same general ledger, the trial balance, they all, you know, just come from that same component, they’re all part of the same piece, you can think about these three items then been reworked, in essence, to get to the statement of cash flows. So the statement of cash flows is going to show the change in cash. So this whole top part of the statement of cash flows, is going to be showing basically, the change in the cash over a time period. So this is the net increase in the cash flow is to 20,000 meaning last year, if you looked at the balance sheet last year, versus this year, and subtracted the two out, there’s a $20,000 increase.

09:14

So it was 80,000. Last year, apparently 100. This year, and then if so if you were to add it add in the beginning balance of last year, this now this last piece of the statement of cash flows is similar to the statement of retained earnings. Right, the statement of retained earnings is tying out the performance on the income statement to what is on this the balance sheet over here. So let’s just do that comparison real quickly. Remember that the income statement gets to net income. If there’s preferred stock that gives us the earnings available to the common stock holder that is tying out then to the statement of retained earnings. And it’s tying out from the prior period balance sheet. Because the prior period balance you’d have 500,000 in retained earnings. That’s what’s not on the balance sheet. And then it’s tying together these two points in time, bringing in the the earnings in the current period minus the dividends to get to the 600,000. And that’s what’s shown on the balance sheet. So it ties out the prior point in time, to this point in time.

10:16

So similar things happen in down here on the statement of cash flows, the top part of the statement of cash flows all the way from here, all the way down to here represents the change. So you can kind of think of this whole whole top piece as basically like the income statement, because it’s telling, it’s telling you the activity that has happened on a cash flow basis. So it’s similar to the income statement of telling you activity, cash flows that have happened on a cash basis. And that’s going to give us the change that has happened in the cash flows. And then this bottom piece, you can think about as similar to the statement of retained earnings as to the balance sheet in that here, we’re going to tie out the change the difference, which is is not on the balance sheet, of course, we’re not, we can’t see that on the balance sheet anywhere. But if we then tie out the prior period, cash, which wouldn’t be the cash on the balance sheet, but would be the cash in the prior period, then we can tie into the Indian balance here, we can tie into the Indian balance, that will will be on the current balance sheet.

11:23

So that’s going to this bottom piece is kind of doing what the statement of retained earnings can do. Now, you might say, why don’t we just tack on that little piece up here on the income statement. And we don’t typically do that because because we have this added thing that could happen in the statement of retained earnings, which will typically be dividends. So we have this added little component that we have to add in down here, we don’t have a little added component in the statement of cash flows, we just have we have the change in cash. And then if we just compare that to the beginning cash balance, we’ll get to the Indian cash. Okay, so net, the statement of cash flows will be broken out into three categories, it’s going to be the cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, the cash flows from operating activities is by far the most complex and usually the largest. And it’s going to be in correlation to some degree with the income statement, meaning we’re going to kind of like reconstruct, basically net income to net income on a cash basis.

12:20

And then the state then the investing activities and financing activities, we’ll deal with cash flows that take place that aren’t really on the income statement. So we’ll discuss that in a little bit more detail as we go here. And the best way to really understand this is to construct a statement of cash flows, which we will do in a future presentation as well. So just note that the statement of cash flows has three parts, cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, it can look very, like intimidating to look at the statement of cash flows, especially when you start at the cash flows from operating activities, which is where you start because it’s on top, because it can be the most complex kind of component of the statement of cash flows. But the next two are usually much, much smaller. So once you get past that first component, then you have like, you know, most of it like 75% of the cash flow, you understand, right, these two should be much easier to understand once you have this first component down.

13:19

And this is going to be equal to the net increase or decrease in cash. In other words, we’ll take a look at the cash flow from these three components. And that’s going to give us the change in cash the change in cash from last balance sheet period in cash to this balance sheet period and cash the difference that has happened, which we will then tie into the Indian balance. So we have the cash flows from operating activities. This is the first section of the statement of cash flows and the most complex one, it’s going to translate net income or income from operations from an accrual basis to a cash basis can be done using two methods. So you can think of this top piece of the statement of cash flows is taking our normal our normal performance statement, which is the income statement and transform and forming that income statement from an accrual basis to a cash flow basis. So the income statement is is showing activity that has happened during a certain time period. On an accrual basis, we’re going to the operating activities, the normal operating activities of the company, and we’re going to basically convert that to a cash flow basis.

14:24

Now there’s two ways we can do this. The most intuitive way would be Hey, look, why don’t we just take the income statement. And it starts with revenue minus expenses. And then we’ll just go line by line and adjust each line item on the income statement from an accrual method to a cash method. So let’s just take revenue and say okay, let’s reverse the things that are cruel about it. Meaning for example, if we made a sale on account that we have not yet collected on then we should remove that sale because we haven’t got that in that’s not included and if we have collected on sales in the beginning of the period for for sales that have been recorded in the prior period, meaning the revenue was recorded last period. And we, under an accrual basis, didn’t record the cash revenue, this period, even though we got the cash this period, we should be recording the cash in this period. And and we’ll talk more about that when we get to actually constructing the statement of cash flow.

15:18

And we could do the same for the expenses, let’s just make every line item on a cash basis as opposed to a accrual basis. So that would be the direct method. It’s easy to explain the direct method to people, it’s a little harder to construct. But it’s easy to explain it. And then there’s the indirect method, which is the one you can’t you have to learn the indirect method, because it’s going to be used most often. So you want to know the direct method and and you want it but you can’t be like, well, I’ll just learn one or the other. And the direct method makes more sense to me, you can’t do that. Because most of the financial statements will be on an indirect method. Why will most of the financial statements be in the indirect method? Oftentimes, it’s going to be required to be so why would it be required to be so because the indirect method actually gives you a reconciliation between kind of like the net income on a cash basis on an accrual basis and the net income on a cash basis, it reconciles the two, whereas the direct method gives you, you know, you basically reconstruct the income statement, but it’s not really giving you a reconciliation to get from net income on an accrual basis to in essence, net income on a cash flow basis.

16:26

So what is the indirect method, the indirect method is going to say, I’m going to start where we left off on an accrual basis, meaning I’m going to take the bottom line number of the income statement. So it’s going to start with net income, bottom line number, the income statement, and then reconcile to cash flows from operations, meaning, we’re going to start from net income and back out all the all the differences between accrual and cash. And then we’re going to end up in and back into cash flows from operations, which is basically net income on a cash basis. So again, you kind of have to know the indirect method, you got to deal with it, even if it’s less intuitive to you. So cash flows from operating activities, indirect method, that’s the one we’re going to have to basically use, it’s going to start with the net income, it’s going to start with net income that comes from the income statement, and then we’re going to have increased depreciation, because depreciation is something that’s that we talked about. And we’ll talk more about it when we construct a statement of cash flows, but it’s a non cash item, right? It’s depreciation that you’re depreciating something that you purchased in the past, most likely, possibly in a prior time period.

17:33

And now you’re allocating the cost to the current period, even though cash wasn’t extended. So that decreased net income, when we calculated the income statement on a cash basis, then we would have to add it back. So if we start with net income, we’d have to add it back, then we’re going to decrease the increase in current assets. Now, I won’t go into this in detail, you can kind of memorize this equation. And we’ll talk more about it when we construct the statement of cash flows, but then you would have to add the decrease in current assets, then you would have to add the increase in current liabilities, and D and D, subtract the decrease in current liabilities. And that would give you the net cash flows from operating activities. Now, I know these these components, like why would you do these can sound a little bit abstract we’ll, again, when we go into the statement of cash flows, it’ll it’ll make a lot more sense. But the bottom line is accounts like accounts receivable and accounts payable.

18:29

Those represents a cruel accounts meaning on a cash basis, you wouldn’t have accounts receivable, because if you were recording things on a cash basis, you wouldn’t record anything until you got the cash. So you wouldn’t record an accounts receivable that represents people owing you money. So therefore, the accounts receivable if you back out the accounts receivable or back out the change in accounts receivable, you can back out from basically a accrual method to a cash method. So we’re kind of reversing into basically, the net income. On an accrual basis, the net income on a cash flow basis, there’s a systematic way that we can put this together, it’s something that the cash flow, how you to construct a statement of cash flow is something that not many people have a good understanding of, if you do have a good understanding of it, you have a much better understanding of, you know, the double entry accounting system in and of itself. So we’ll go into that in some detail when we construct the statement of cash flows. But bottom line you need from a finance perspective to be able to use the statement of cash flows and understand the different segments within it so that you can make analysis on it.

19:36

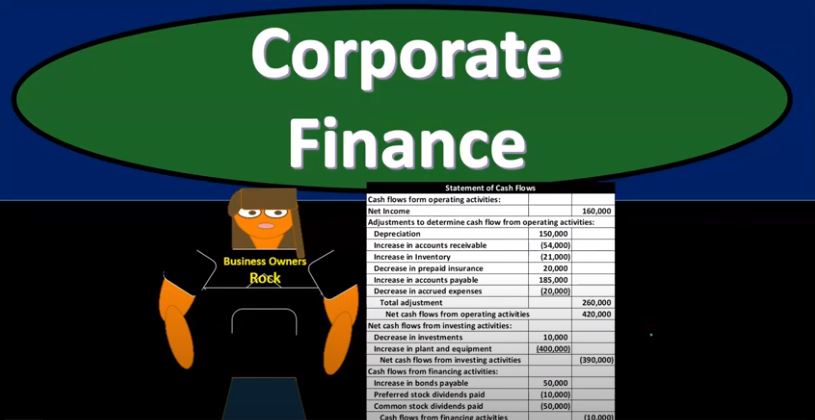

So we have the cash flows from operating activities. This is what the operating activities kind of looks like or an example of it. This is just the first third of the statement of cash flows. But again, it’s the longest third. So even though it’s only like one of three parts of the statement of cash flows, you could still think of it as like 75% of the statement of cash flow, right? If you understand this, then you’re pretty much getting you’re pretty much there, right? So this is Gonna be the first part first of three sections of the statement of cash flows. That’s the cash flows from the operating activities, we’re using an indirect method, because that’s the method that will, you’ll typically be seen, it’s, it’s required by some regulatory bodies. So we’re going to start with net income, that number would come from the income statement, then we’re going to add back in the depreciation, which is really like the change in the accumulated depreciation on the balance sheet. So we’re going to add that back in. And then we’re going to take these accounts that the receivables inventory, prepaid insurance, accounts payable, accrued expenses, those are all balance sheet accounts.

20:35

And you might say, I thought we were reworking the income statement. Why is it that you’re showing me changes in balance sheet accounts, because just just like, we saw that, that that, that the the income statement is basically in and of itself, showing the change in the retained earnings, the retained earnings from the prior period to the chain retained earnings in the current period is, is the difference between the two, the major difference is the net income. Well, that same concept applies out out here. So if we take the change in these kind of accrual type of accounts, then we can basically back into like the activity. So we’re taking the change where we were where we were at prior period in accounts receivable to where we are at in the current period and accounts receivable, the difference between those two is the activity that has happened. So that’s why we’re looking at basically balance sheet accounts to back out or get or back into basically the activity that is happening.

21:36

So that means we’re going to go through these kind of accrual accounts that are on the income statement, such as accounts receivable, which once again, is an account that wouldn’t be there. If we were just doing a cash basis, we’re gonna look at the change, and this one happened to be an increase in accounts receivable. Since it’s an asset, we’re going to decrease it here. The inventory once again, inventory is an accrual account, if we wouldn’t have inventory as an asset on the books if we were on a cash basis, because when we paid the cash for inventory, we would simply just record it as an expense at the point in time we paid the cash. So if we take the difference between inventory prior period and current period, we can back into the activity for it. And then we have that prepaid insurance. So insurance prepaid insurance as an asset account that we we paid for before we got the insurance.

22:22

Once again, if we were on a cash basis, we wouldn’t have a prepaid account, we would just when we paid the cash, we would expense it at that point, then we have the accounts payable change that we’re recording here, we wouldn’t have accounts payable if we were on a cash basis, because when we would just record the payment, not when we owe the money, tracking how much money we owe on the balance sheet. But rather when we just pay it, we’re just going to record the expense at that point. And we wouldn’t record the accounts payable at all under a true cash basis. And then the same for accrued expenses. So if we add these up, these are going to be the change that’s going to be that 260,000 here’s the net income before, we’re going to have to add this back in to move from a cash basis to to an accrual basis to a cash basis. That gives us our net cash flows from operating activities.

23:09

So this is basically like net income from an operating activities. So you can see you have this nice reconciliation, it doesn’t just reconstruct the income statement, it ties out net income on the income statement to basically net income on a cash basis. That’s why you know, some regulatory bodies like that reconciliation item. So then we have cash flows from investing activities. The second section, long term investment activities, in mostly property, plant and equipment. Now, the most confusing thing about this one is the second component is that usually, people think of investing activities as invest investing in stocks and bonds or something like that. And they might have investments in stocks and bonds could be part of it. But the major component will typically be the activity that has happened happening in long term investments in property, plant and equipment. So property plant and equipment like your you bought a building or something like that, or you sold a building or you bought equipment, you bought a forklift, those things are investing activities, they’re not part of operating activities.

24:11

Because if you think about it, if you were to buy a building on an on an accrual method, the purchase wouldn’t be on the income statement, meaning if you bought a building for $300,000 cash, like we discussed before, you wouldn’t just expense it on the income statement. Even if you paid cash at the point in time you purchased it, but rather put it on the balance sheet. So it’s going to be something that doesn’t tie out to basically the operating section because it’s it’s even if cash went out, we put it on the balance sheet, because it was an investment that we’re then going to allocate the cost over time using an accrual basis method. So So here we’re gonna, we’re gonna, those are going to be the major investments and most people they might when you hear the word investment, it means different things depending on the context you’re talking about. So we’re talking many of the large investment activities that we’ll be here will be investments in property, plant and equipment things that we capitalize because they were large purchases. So we have an increase in cash flows often represents a sale of investments like property, plant, and equipment resulting in cash flow, or a decrease in cash flows generally represent cash outflows for investments like property, plant and equipment.

25:23

In other words, if we purchased property, plant and equipment, and we paid cash for it, then we have to recognize that cash flow, and we’re not. And we’re going to put that not on the operating activities, because it wasn’t part of the current periods operation, but rather here in the investing activities. And if we purchased, that’s going to be a decrease, right, we’re going to show a decrease in cash flows related to us purchasing equipment. If we sell equipment, then we’re going to record an increase in cash flows related to the sale of the equipment. Now, if there’s a gain on the sale, or something that could have an effect on the operating activities, because that’s something that would, would be on the income statement that we’ll have to deal with. But if we just sold equipment, and there was no gain or loss we sold at a cost, then we would see and we got cash, then it would be back portion of the cash inflow would be in the cash flows from investing activities. Okay, so it’s gonna look something like this is going to be a lot smaller, typically, although it can be a little bit complex, depending on the number of transactions that you have. So we have the net cash flows from investing activities. So if there was a decrease in investments, so if we had investments, and they basically went down, you would expect them that cash would have been increased, right?

26:40

Because we sold the investments, so cash would then go up, so an asset would go down, cash would go up, and we would record the cash flow here, because there’s no effect on the income statement, unless there’s a gain or loss, which we would have to then deal with on the income statement. And so that’s a difference, we’ll go into that more detail later, increase in plant and equipment. So if we bought property, plant and equipment, like a forklift or something like that, a building or something like that, then cash would go out. And therefore we would have a decrease in the cash flow. Now, if we financed it too, then we might have a loan that would be involved in it. So we’d have to break out the loan portion, which would not be cash related, and and whatnot, in the financing on the loan and the payoff of the loans. And that kind of thing would go into typically the financing activities, okay, so then we have the cash flows from financing activities, includes the sale of sales or retirement of bonds.

27:35

Now, when you’re thinking about bonds, these are these are kind of like you’re thinking of similars notes or loans, meaning if you need to finance money for the company, we need more capital, we need more money, then we can either get a loan from the bank, or we can try to issue bonds, if we’re a large corporation, we can issue bonds possibly to a broader range of people, but it would still be like a loan that we got to pay back. And so we have that we have the common stock. So when we issue common stock, preferred stock, we have the other corporate securities and payment of cash dividends. So these are all going to be in the financing activity. So financing activities, as you would expect, would be financing through us. We’re trying to generate capital, typically you’re thinking about things that generate capital, in the two ways you do that, either, you know, are with loans, liabilities, or with the some some type of equity financing, like issuing stock.

28:29

So that means if you’re looking at financing activities, you’re thinking about things like the notes, the loans, the bonds, the common stock when it was issued when we issue new common stock in order to generate revenue in the company issue, the preferred stock, and then when we pay make payments to the owners of the company, that’s going to be the dividend payments. So a sale of a company’s securities is a source of funds or cash flows. So a sale would be cash flows coming in a repurchase of securities is a use of funds or cash flow going out. And a payment of dividends is a use of funds or cash flows going out. So the cash flows from financing activities could look something like this. For example, cash flows from financing activity increase in bonds payable, so bonds payable went up, that’s like a note payable kind of like a loan, but similar to loans a bond that we owe. So if it went up, we would expect that we got money. So cash flows would be increasing, because we would expect that we increased the bonds, preferred stock dividends and common stock dividends.

29:32

Those were obviously cash flow that went out. So they went out they’re not part of operating activity because they’re not part of like the income statement type of thing and performance statement. They’re down here on the finding Nancy activities even though cash went out, that gives us the cash flows from financing activities. So if we put this whole thing together, then we have the cash flows from we got the statement of cash flows, cash flows from operating activities that we saw this whole big piece. That’s the biggest Piece once again. And that’s going to give us our right here, net cash flow from operating activities, then we’ve got net cash flows from investing activities, which is much smaller, you can see here as we looked at, and then we got the cash flows from financing activities, that’s going to be this component here. Now, if we were to add up to those three components, that’s going to give us the change in cash flows. So if we add up those three components, for 20,000, plus to 390,

30:27

I’m sorry, minus, minus the 390 thousand minus the 10,000. That’s going to give us our change. So that’s like what happened during the current time period, kind of like the income statement, where we where we would say, How far did we go in the current time period? And what was the change in cash? Now cash could increase or decrease, right? Whereas revenue you would expect always to be increasing? You know, you’re hoping that it’s going to be on the increase type of thing. But any case, you’re going to say, what’s the change? How far did we go in the current time period, that’s going to be the activity. So if we started from, for example, if we started from zero, if we put the odometer at zero and counted up, we would have said, Now we increased by 20,000. Obviously, cash went up and down, it didn’t go just one direction, because cash is flowing in and out here. But we had a net increase of the 20,000 in the cash flow. And then if we compare that and we say,

31:22

Okay, well, we weren’t at odometers, zero at the beginning of this race, you know, at the beginning of the timeframe, we were we have 80,000, currently, as a prior year, on the balance sheet in the prior period for cash. And it’s like, Okay, well, then, if we started at 80,000, and we increased by 20,000, for the year, that means we’re at 100,000. At the end of the year, this is going to be that kind of like the statement of retained earnings that ties out the balance sheet and the income statement, this is the bottom portion of the statement of cash flows, that tat ties out the balance sheet of prior period to the balance sheet of the current period of 100,000, then showing on the balance sheet here for that 100,000. So here we have the our all of our statements.

32:07

So just to recap, remember that these three statements, when you think of the financial statements, you think of these two first balance sheet income statement, and then the statement of retained earnings, linking those two together, then we can kind of think of the the statement of cash flows, reconstructing the balance sheet and the income statement, the first port portion of the statement of cash flows, basically reconstructing the income statement, but often doing so with an indirect method, meaning we’re going to start with the net income on the income statement and reverse back into the the cash flows on a on a cash statement, or net income on a on a cash basis, as opposed to a direct method, where we would RE DO each line on the income statement in accordance with a cash method as opposed to a non cash method. Then we have those cash flow items here that are not part of normal operating activities.

33:04

And that includes the investing activities that weren’t on the they’re not reflected in the income statement, which are normal operating activities, even if we paid them for cash, for example, purchasing equipment, even if we purchased it for cash, we put it over here in an investment, because it’s going to be you know, influencing future periods. That property plant and equipment the purchase and sale of it is the major component cash flow related to purchase and sale of property, plant and equipment major component of the investing activities. Although we could have other investments that do increase in decrease as well, you’ll find that the property plants and equipment is a major component of these investing activities.

33:44

financing activities deal with the liabilities here, increasing and decreasing of the liabilities, because that deals with financing of the company if we’re trying to generate capital through some form other than revenue, generation of event income generation through revenue, and then anything that deals down here with with his stockholders equity, such as issuing the preferred stock, or the common stock in order to generate one financing financing activity, we’re issuing stock to generate capital money and the company and then the giving of dividends, the distribution of dividends will be down here. That’s going to give us our change. So the net change being here that we saw. And then if we tie that out to the beginning cash, which isn’t on any of these statements, where would it be, it would be on the balance sheet but for the prior time period, and that then will tie us out to the current period that the balance sheet on the current time period this bottom component than being the link between the last period cash balance and this period, cash balance last periods balance sheet and this periods balance sheet