Advanced financial accounting a PowerPoint presentation. In this presentation we will discuss enterprise wide disclosure, get ready to account with advanced financial accounting. enterprise wide disclosures established by ASC 280 standards provide users more information about the company’s risks generally made in a footnote to the financial statements. First category of required information to include under ASC 280 is information about products and services so information about products and services disclosure related to them. Companies are generally required to report revenues from external customers for each major product and service or each group of similar products and services. Unless doing so is not practical. primary reason for this is that the company could have organized its operating segments on a different basis from the organization of the entities product lines. So we’ve got then again, companies are generally required to report revenues and external customers for each major product and service. You might be saying, hey, well, they already have the segment’s reporting. But it’s possible that those two things don’t exactly line up in the way they put the segment reporting together and therefore, you know, you have this requirement. second category of required information to include under ASC 280 is going to be related to geographic areas information. The following needs to be reported unless it would be impractical to do so. revenues from external customers attributed to the company’s home country of domiciled revenue from external customers attributed to all foreign countries in which the enterprise generates revenues.

Posts with the assets tag

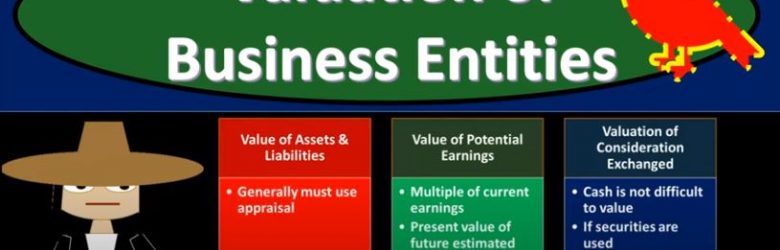

Valuation of Business Entities

In this presentation we’re going to talk about valuation of business entities when there’s going to be an external expansion. In other words, a merger or consolidation, get ready to act because it’s time to account with advanced financial accounting. We’re continuing on with our discussion of external expansion. That means we’re have two separate entities that are going to be combining in some way shape or form. The two types that we want to keep in mind at this point is the acquisition of assets and the acquisition of stocks. So if the acquisition of assets we have one company acquired another assets using negotiation with management, so that means you have two separate entities and one entity is basically going to be purchasing the assets of the other entity versus the acquisition of stock, where we have a majority of outstanding voting shares is generally required, unless other factors result in the gaining of control. So in other words, you have two entities, one entity in essence buying a controlling share or controlling ownership over 50% typically 51 and above. Have another entity. So from an accounting perspective, then the question is, well, how are we going to value the assets and liabilities. Now when we think about the assets and liabilities, we may have to use an appraisal oftentimes, in order to do so because remember, if you’re talking about some assets, they might may be on a fair value method, because you might be talking about cash or something like that, or possibly stocks or investments in that way, that may be easy to value with a market method. However, if you’re talking about things like property, plant and equipment, then it’s going to be more difficult to know what the value is. That’s the problem because there hasn’t been a market transaction for that exact same piece of equipment for some time.

Forms of Business Combinations

This presentation we’re going to talk about forms of business combinations, which is basically external expansion, two types of entities that are going to be related in some way, shape or form, get ready to act because it’s time to account with advanced financial accounting, forms of business combinations. Now remember, we’re talking about expansion. Here, we’re thinking about expansion. We’ve got the two categories, we’ve got the internal expansion and external expansion. We’re considering here, the external expansion, we have an organization that now wants to expand and they’re going to be consolidated in some way or have two separate entities that will be combining. So now we’re talking about two separate legal entities typically separate legal entities that are now going to be combined in some way shape or forms. The forms of business combinations can be the statutory merger, the statutory consolidation, and the stock acquisition. So if you think about, in other words to separate legal entities and say, Alright, well how can these two separate legal entities be combined in some type of way, you can imagine some different Kind of scenarios in which that could take place. So and when you’re imagining those different types of scenarios, you’re going to be thinking about, okay, well, what’s going to be the key factor here, it’s going to be the controlling interest. So what’s going to be a situation where you had two separate legal entities, and now they’re they’re going to be have some controlling relationship, which could be that they’re combined together under one entity at some point or they are having a parent subsidiary type of relationship, in which case the control would be over the 50%. So that control concept is what you want to keep in mind here.

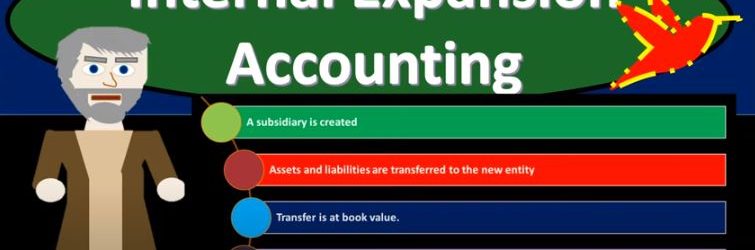

Internal Expansion Accounting

In this presentation, we will expand on the logistics of internal expansion, get ready to act, because it’s time to account with advanced financial accounting. We’re going to take a look now at the steps of the internal expansion. So note we have the two categories of expansion, the internal expansion and the external expansion, internal expansion with a company growing, we’re imagining the company growing, they can either grow internally make it another sub subsidiary, possibly, that would be owned by the parent company creating a parent subsidiary relationship internally, or has some kind of external expansion where we have two separate entities that are going to be together in some way, shape or form. So here, we’re talking about the internal expansion. So we have one company that is then thinking about expanding how are they going to put that expansion together? We’re thinking about the setting up then in this case of another legal entity such as a subsidiary, what steps for that? Well, first, you’re going to have a sub sub subsidiary B. created. So you get the parent company is going to be creating the subsidiary, then we have assets and liabilities are transferred to the new entity. So we’re imagining we have one company that wants to expand possibly have another division or another location that they will be expanding into. They make this subsidiary so they another legal entity created, we typically will think of another corporation that is owned by the prior Corporation, parent subsidiary relationship, the assets and liabilities that are going to be controlled or be part of that new segment are going to be transferred from the parent company now to the subsidiary company. And the key point here is that it’s going to be transferred at book value. And you might be thinking after looking at the external expansion, where you have two separate entities that are coming together and the need for us to then use the basically the acquisition method treat it basically like a sale happening.

Business Combinations Methods

In this presentation, we will take a look at business combination accounting methods, both historic methods and the current methods get ready to act, because it’s time to account with advanced financial accounting. We’re going to start off with business combinations from the past, these are not the current method that we’re going to be using. However, it’s good to have some historical context so that if you hear these methods, you know what you’re talking about. We also want to think about these concepts in terms of just a logistical standpoint. If you were to make these laws, then how would you do it? What are some of the challenges that have happened? And by looking through the historical process, you can kind of think about, okay, these are what were put in place, I see why those were put in place here that changes that are happening, we could see why the changes are happening, therefore have a better understanding of what we are doing, and how the current process is being put in place and why the decisions were made to put it in place. So in the past, we had combinations methods that included the purchase method and the pooling of interest. method. So they then what happened is the pooling of interest method was taken away by faz B. So faz B said, Hey, we’re not going to allow anymore, the pooling of interest method, and then the purchase method has been replaced with the acquisition method. So if you hear the purchase method, that in essence is what we’re currently doing. However, we changed the name from the purchase method to the acquisition method.

Internal Business Expansion

In this presentation, we’ll take a closer look at internal business expansion, get ready to act because it’s time to account with advanced financial accounting. In our previous presentation, we talked about the types of expansion that a company can take. And we broke those out into the general categories of internal expansion and external expansion. The internal expansion, meaning we have a corporation or a company that needs to expand wants to do so internally might result in other divisions or might result in a creation of a subsidiary, the external expansion meaning we have two entities that are separate and somehow come together, which still could result in something like a parent subsidiary type relationship, or some type of division. So we’re going to be considered here the internal ideas the internal concept or internal expansion. So we have one organization, the organization wants to grow and expand possibly into a different sections or segments are different industry, and therefore they’re going to expand in some way shape. shape or form. Typically, we’re thinking of the creation in this case of a subsidiary type of relationship, in which case, they might create a separate legal entity. And that would be the giving of the assets and possibly liabilities to a separate legal entity that would be created. In other words, the parents company, setting up a subsidiary in some way, shape or form. And then given the subsidiary some assets and the liabilities that were formerly the parents organization, and then having a parent subsidiary type relationship with that subsidiary unit, us from an accounting standpoint, then having to think about how are we going to account for that with regards to financial accounting with that parent subsidiary type of relationships. So types of business entities that could be involved with this, we could have a subsidiary company and that’s the one you’d probably most be considering.

Measurement Period and Contingent Considerations

In this presentation, we will discuss measurement period and contingent considerations within an acquisition process, get ready to account with advanced financial accounting. At this point with the discussion of the acquisition process, you’re probably thinking, Okay, I kind of see how this fits together. I’ve see how this works. But logistically, it could still be a little bit tough. If you were to apply this in practice, you’re probably saying, Hey, there could be some problems. In practice. If we were to apply this out. For example, if we’re saying, okay, we’re going to revalue the assets and the liabilities. And we’re going to value the consideration we’re going to make a comparison of the value of the assets and liabilities to the consideration that’s being given for the company that in essence is being acquired in the acquisition process. Well, then what about that valuation process? That’s going to be difficult because how do we revalue the assets and liabilities because normally, when you value something, you value it from a market perspective, which means there’s actually a transaction a sale that’s taking place. So note obviously that valuation process is going to be somewhat of a tedious process for us to go through and revalue. And how long do we have for that to take? I mean, if this isn’t happening basically instantly with regards to this process, this is going to be taking some time.

Other Intangibles

In this presentation we can continue on discussing acquisitions, this time talking about other intangibles other intangibles other than goodwill, get ready to account with advanced financial accounting. We are talking here about intangibles that must be recognized separately. So in prior presentations, we talked about an acquisition process and the recording of goodwill and the calculation of goodwill. Through that process, you’ll remember that we talked about the revaluation we had to reevaluate the assets and liability of the company that’s been acquired to their their value and then consider that or compare that, to the consideration that’s being given we can think about goodwill. Now in that process, however, we might have some other intangibles that need to be valued at that time as well, other than just simply the goodwill. So for example, we might have marketing related intangibles things like Internet domains and trademarks. So instead of just basically lumping everything into goodwill, we got to say okay, all right. They’re going to be marketing related intangibles like the internet domains and the trademarks that we need to apply some of that intangible amounts to we need to value in essence, those things as well breaking them out from just basically a kind of a lump sum valuation of goodwill.

Acquisition Accounting Bargain Purchase

This presentation we’re going to continue on with our discussion of acquisition accounting, and this time focusing in on a bargain purchase, get ready to account with advanced financial accounting. First off, we can basically think of the bargain purchase as the opposite of goodwill. So in a prior presentation, we talked about the concept of goodwill within an acquisition, which would be resulting if the fair market value of the amount that was given like basically the purchasing price was greater than the fair market value of the net assets. So in other words, we take we look at the books of the company that’s being acquired, we’ve revalue their assets and liabilities to be on a fair market value, then assets minus liabilities, the equity section, the net assets now at a fair market value, we take a look at that. And if there’s a consideration that’s given that is greater than that amount, that then would result in goodwill. Now goodwill is quite common, because it’s unlikely even if you even if you re assess all the assets and liabilities to their fair value. Then you would typically think that the price would either be that that would be given the the amount that would be exchanged, the fair market value of the consideration would be the same as the assets minus the liabilities at fair market value, or more, because there’s some type of goodwill, that’s going to be that’s going to be in the organization. Now, you might be thinking, Well, what what if it was the opposite? What if you took the fair market value of the net assets, and the amount that was given the exchange amount was less than the fair market value? Now that could happen, but just note that that’s a lot more unusual.

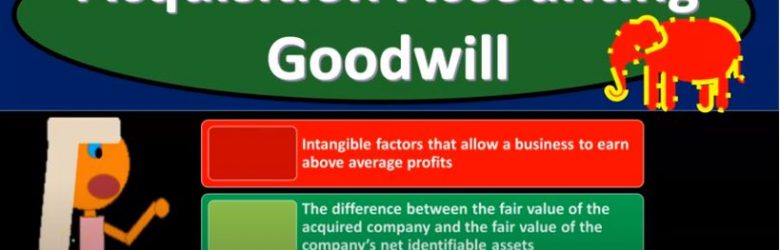

Acquisition Accounting Goodwill

In this presentation, we’re going to continue on with our discussion of acquisition accounting, this time focusing in on the concept of goodwill. Get ready, because it’s time to account with advanced financial accounting. First question is, what is goodwill. So it’s an intangible factors that allow a business to earn above average profits. So the way you might want to think about that is the first thing about a business that isn’t being purchased and sold. If you just got one business that started from scratch, they just started doing business, they started earning revenue, then you can look at their financial statements, they got the they got the balance sheet, assets minus liabilities is the book value of the company, and then the income statement, which is their performance. Now, if you were to say, Hey, is this company worth more than their equity than their assets minus the liabilities than their net assets? In other words, if it is, then you’re saying hey, there must be some intangible factor that’s not really on the balance sheet that would explain the reason why the you know the value of them because most likely through Profit generation, after the the perceived ability, the likely ability to earn profit in the future is greater than just what’s on the balance sheet assets minus liabilities. So you would think then that many companies, if a company is doing well, then there’s going to be some kind of intangible factor there. That’s not basically on the balance sheet that basically explains why the company is doing better than then just the value of the company being assets minus liabilities. So in other words, if we were to purchase the company, you would think that you would purchase it for their assets minus the liabilities, that’s what they consist of, that’s breaking them down to their parts.