Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial markets Get ready, it’s time to take your chance with corporate finance, financial markets, financial markets help to provide indicators for maximizing shareholder value. So when we’re thinking about financial markets, we’re thinking about markets. In general, we’re thinking about purchasing and selling things, a place where people purchase and sell items, that means there’s competition, there’s different people competing within a market, that will typically lead to better information about the value of the items being sold.

Posts with the stock tag

Financial Management Goals 125

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial management goals Get ready, it’s time to take your chance with corporate finance, financial management goals. Now, as we’re thinking about the financial management goals, we’re thinking about corporate finance, we’re typically thinking about a corporate structure. So management, how does management fit into the structure of a corporation, the owners of the corporation are going to be the shareholders of the corporation. So if you think about a large corporation, then you’re thinking, well, the shareholders shares are trading all the time, possibly on an exchange for a large corporation.

Finance Topics & Activities 115

Corporate finance a PowerPoint presentation. In this presentation, we will discuss finance topics and activities going over some of the historical emphasis in the field of finance to get some context of where we’re coming from and where the current emphasis is. And we’ll be in corporate finance, get ready, it’s time to take your chance with corporate finance, finance topics and activities, we’re going to go over some of the emphasis in corporate finance in the past up into the present day to get some focus in on in context of what we will be talking about within corporate finance. So in the 1930s, what’s the emphasis in corporate finance in the 1930s, we have capital preservation.

Push Down Accounting

Advanced financial accounting. In this presentation we will discuss push down accounting as it relates to parent subsidiary relationships controlling interest interest over 51%, where we have consolidation accounting taking place, we’re going to be applying pushdown accounting to it, get ready to account with advanced financial accounting. So the concept of pushdown accounting will take place when we have the parent subsidiary type of relationship and we have a situation where the purchase price when the parent purchased the subsidiary, the purchase price was more than the book value of the subsidiary, which could complicate of course the consolidation process as we’ve talked about in prior presentations. So we have a couple different options that we could do.

Consolidation With Difference Simple Example

Advanced financial accounting. In this presentation we’re going to talk about the consolidation process with a differential we’re going to look at the component parts with a simple example a simple calculation, you’re ready to account with advanced financial accounting, consolidation with differential example. So here’s going to be the basic scenario for many of the practice problems we will be looking with. We have P and S, there’s going to be a parent subsidiary relationship in which we will be making consolidated financial statements. How did this situation take place what constituted this situation, we’re going to say that in this example, P is purchasing the stocks of S. So notice they’re purchasing the stocks of s and therefore negotiating the stock price, which we’re going to say is $1,000 here. Now to simplify this example, you first want to think about this as p purchasing 100% of the stock of s for $1,000. And then once they have control, anything over 51% would then be controlled.

Usefulness of Consolidated Financial Statements

Advanced financial accounting. In this presentation we’re going to take a look at the usefulness of consolidated financial statements. In other words, consolidated financial statements taking two or more companies where there’s a parent subsidiary relationship, putting them together representing financial statements as if those entities were one entity. What are the pros and cons of using consolidated financial statements? Get ready to account with advanced financial accounting idea of consolidated financial statements? In other words, why did we come up with the consolidated financial statements? So remember, we’re talking about a situation where there’s a parent subsidiary relationship, there’s a controlling interest, we have one company that has a controlling interest in over 51 interest in the other company. And then we’ve come up with this concept of showing the Consolidated Financial Statements showing the entity the parent and the subsidiary entities of which there’s a controlling interest as if they were one entity. Why do that? So when company creates or gets controlled Another company, that’s going to be the scenario we have. So we have a parent subsidiary relationship due to that fact due to one company having control than another company. You can think of that, of course in a stock situation owning for more than 51%. The result is a parent subsidiary relationship. So if we just have the two entities, it would look something like this.

Consolidation – Interim Acquisition

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidation and interim acquisition. In other words, we have a parent subsidiary relationship that parent owning a controlling interest over 51%. However, that controlling interest took place for a purchase of the common stock of the subsidiary that happened in the middle of the year. So prior to this, we’ve been talking about situations where we are doing consolidations for an entire year. And you may have question probably popped up in your head at some point in time as well what would happen if the purchase took place in the middle of the year now we have that mid year kind of purchase worse, especially concerned with that first year where the consolidation didn’t really happen. I mean, there wasn’t a consolidated ownership until sometime in the middle of the year, get ready to account with advanced financial accounting. So we’re talking about a situation where we have a consolidation but the consolidation happened in the middle of the years. We’re thinking about that first year, primarily What would happen? Well, if the consolidation didn’t take place in January in other words, the parent didn’t purchase the controlling interest in the subsidiary at the beginning of the year but happened at some point in the middle of the year what’s going to be the impact on the year in consolidation, which typically happens for the entire year? Well, the subsidiary is seen as being part of the consolidated entity from the time the stock is acquired, even if acquired in the middle of the year.

Consolidation & Subsidiary Stock Dividends

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process and a situation where the subsidiary issues stock dividends we have stock default dividends issued by the subsidiary what will be the effect on the consolidation process get ready to account with advanced financial accounting. We’re talking about a consolidation process where the subsidiary then issued stock dividends. So we have stock dividends are issued to all common stockholders proportionally, therefore, the relative interest of the controlling and non controlling stockholders is not changed. So that relative interest isn’t changed, so we don’t have to worry about that which is nice. The carrying amount on the parents books is also not changed. So we’re not going to have to change anything on the books of the parent with basically an adjustment to the investment account using you know, typically the equity method, which is nice stockholders equity accounts for the subsidiary do change. So we do have a change to the stock There’s equity on the subsidiary, but total stockholders equity does not. So in other words, if we take stockholders equity as a whole, there’s no change there, even though there’s changes within the stockholders equity of the subsidiary. So we’re here we’re going to say this stock dividends represent a permanent capitalization of retained earnings. That’s basically what is happening, permanent capitalization of the retained earnings.

Consolidation When there is Complex Ownership Structure

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to discuss a consolidation that when there is a complex ownership structure, so more complex ownership structure comparing the direct ownership, which is what we’ve normally been dealing with, with structures such as multi level ownership and reciprocal ownership, get ready to account with advanced financial accounting. Normally, when we think about our consolidation structure, we’re dealing with a direct ownership situation which looks like this direct ownership type of situation, it gets more complex. Of course, if we have more complex type of ownership structures, such as a multiple multi level ownership structure where we have a parent owning a subsidiary, that basically we have an indirect ownership, let’s say in another subsidiaries, that’s going to be more complex for us to deal with or if we have a situation where we have reciprocal ownership, where the parent has ownership a controlling interest in s, but as also has some ownership in p, right. We’ve been dealing with basically P parent company owning portion of S. So if we talk about direct ownership we’re talking about the parent has, as has controlling interest in every subsidiary. So that’s going to be of course, this situation.

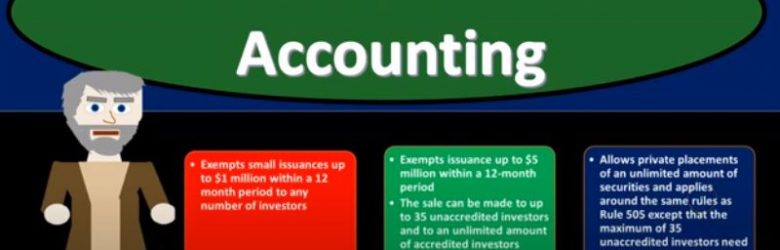

Registering Securities with SEC Process

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the process of registering securities with the SEC, the Securities and Exchange Commission get ready to account with advanced financial accounting, issuing securities. If a company wants to sell debt or stock securities in interstate offerings to the general public, they are usually required by the Securities Act of 1933 to register those securities with the SEC. So one more time, we’re talking about the issuing of securities if a company wants to sell debt or stocks securities in interstate offerings to the general public, so now we got the interstate offerings going to the general public, in order to have that benefit. They are usually required by the Securities Act of 1933 to register those securities with the SEC. And you can see we saw a little bit of history in the prior presentation on how this could develop. Obviously, it’s going to be a benefit to the businesses in order to To generate capital typically to be able to offer the stock to the general public in interstate offerings. But in order to do so then you would think you’d want to have some transparency that will be involved in it so that both sides of the negotiation will be involved. That’s where the SEC came into play here. So we talked a bit about the SEC and its role in a prior presentation we’ll get more into the process of the registration here. General financial statement required for this process will typically include two years of balance sheets three years of statements of income, three years of statements of cash flows, three year of statement of stockholders equity, prior years statements are generally presented on a comparative basis with the current years it will typically have a comparative basis. For the for the comparative years prior and current year.