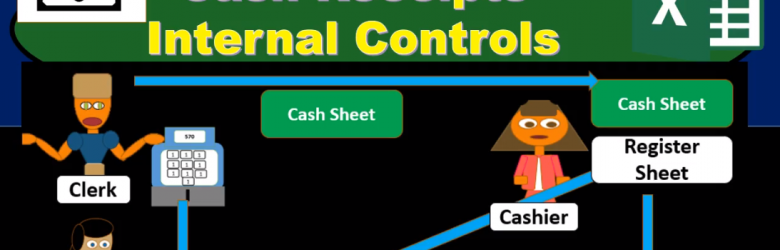

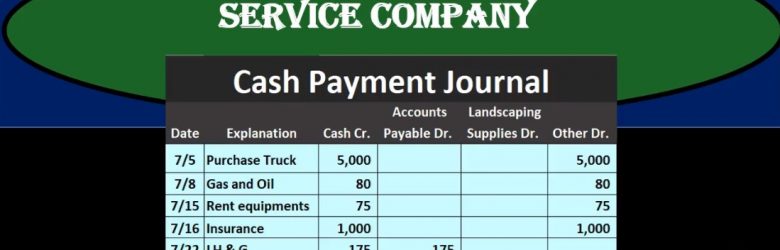

In this presentation, we will talk about cash receipts, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happen. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request the payment may even you know, enter the payment into the system.