Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss translate financial statements of foreign subsidiary, get ready to account with advanced financial accounting, translate financial statements of foreign subsidiary. So we’ll go through the general process of the translation process for the revenue and expenses, the average exchange rate for the period covered by the statement is the rate that is generally going to be used. And again, this would make sense, because if we’re talking about the revenue and expenses, we can’t really pick one rate, because that is a statement of how the performance did over time from beginning to the end. And therefore we need to use some kind of rate that would be representative and it wouldn’t really make sense to use the rate at the end of the timeframe but possibly some average of it. So a single material transaction is translated using the rate in effect on the translation date. So then there could be an argument that could be made we could say okay, so We’re not going to use just one rate, like at the end of the time period like we’re using on the balance sheet generally, because that would make more sense on the balance sheet because it’s reported as of a point in time. But on the income statement, yeah, it makes more sense for us to use some rate that’s kind of reflective of the timeframe. So possibly we’ll use an average rate. But what if we have this really material type of transaction that’s really large transaction, maybe in that case, we should we should deviate from just an average rate and use the rate as of that point in time or like a historical rate at that point in time. assets, liabilities and equity. So now we’re talking about the balance sheet. So for the most part on the balance sheet, you would think all right, it would make more sense then for us to be using the current exchange rate, which would be as of the date of the balance sheet date. So which says as of the end of the time period, if we’re talking for the for 1231 income statements or financial statements for the year ended 1231 then we’re talking 1231. The end of the time period is when all the balance sheet accounts are reporting as Oh, As of that point in time, and therefore, for the most part, you would think that the current exchange rate, the rate as of that point in time would work. However, you can also think that the historical exchange rate might be used for some items, some, again, some kind of large items power, possibly for the property, plant and equipment.

02:17

And then you got the retained earnings where you’re gonna say, okay, retained earnings, it’s kind of a special case, because the retained earnings is including part of the income statement part of the performance. I mean, the retained earnings is comprised of the retained earnings prior to the time period that’s covered by the income statement and the time covered by the income statement. So So and on the income statement, of course, we’re recording revenue and expenses basically using the average rate here. So then of course, when we think about the retained earnings on the balance sheet, we do the calculation for the retained earnings, which is beginning balance plus the net income minus dividends equals the ending balance. So the beginning balance is going to be mixed. Some kind of mixed based on What happened in the prior in the prior years, and then the net income generally is going to be using our average method, because that’s what we’re going to use for the revenue and expenses. But the dividends are going to be a balance sheet account, which we typically use a historical rate on. And that means that that means that the ending balance, of course, is going to be mixed, and then it’s going to roll forward to the next time period. So the retained earnings is a is a bit complicated because of that. So then we have the translation adjustment is part of the comprehensive income. So you can see here that we have potentially different rates that could be used as is. And the point of that, then, is that if we’re not just going to translate the entire financial statements, which were in balance, using one translation rate, then then we’re going to end up with something that’s going to be out of balance.

03:47

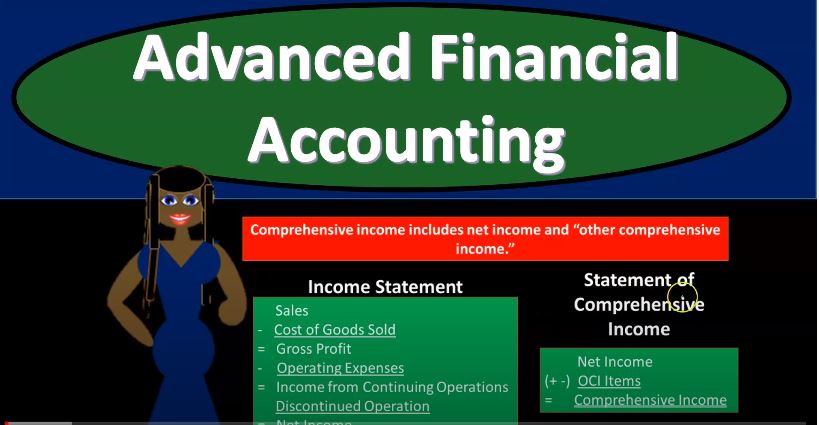

And so what are we going to do with that? Well, the comprehensive income, it’s going to go to the comprehensive income, the translation, adjustment is going to be part of the comprehensive income. So comprehensive income includes net income and other comprehensive income So on the income statement, obviously we have sales minus the cost of goods sold gives us the gross profit, we have the operating expenses, and then minus the operating expenses gives us the income from continuing operations, and then any discontinued operations that’s going to give us then the net income. And then the statement of comprehensive income is going to be the net income plus or minus the other comprehensive income items of our give us the comprehensive income. So we’ll be able to kind of report it, you know, in a separate in its own section and the other comprehensive income not affecting the primary net income line. So other comprehensive income would include things like changes in foreign currency translation adjustments, unrealized gain or losses on available for sale securities may be in the other comprehensive income. deferred gains and losses from certain derivative contracts could think be include things that may be included in other comprehensive income, other comprehensive income and statement of changes In stockholders equity, other comprehensive income is closed into accumulated other comprehensive income each period. So the other comprehensive income, we got the income statement, which we know are temporary accounts, we’re going to basically have to close them out. other comprehensive income you can think about is like an income statement account as well. But normally, the net the net income for a corporation is going to roll into retained earnings in the closing process. And then the other comprehensive income is going to roll into kind of like an equity account something that’s typically recorded in equity as well, but being called accumulated other comprehensive income, and the accumulated other comprehensive income is displayed separately from the stockholders equity items. So a statement of changes in stockholders equity could include accumulated balance of other comprehensive income items at the beginning of the period, plus or minus change in translation, adjustments and additional, other and additional accumulated other comprehensive Income items, and that’s going to give us the accumulated other comprehensive income balance at the end of the period.